Natural Gas News – August 31, 2023

Natural Gas News – August 31, 2023

Natural Gas Prices Rise As Supply Risks Persist

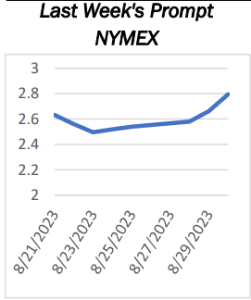

European and U.S. benchmark natural gas prices rose early on Monday amid concerns about supply due to still unresolved labor issues at Australian LNG export facilities and planned maintenance reducing Norwegian pipeline gas deliveries to Europe. Prices at the Henry Hub in the United States were up 2.6% early on Monday. In Europe, the front-month futures at the Dutch TTF hub, the benchmark for Europe’s gas trading, had increased by 1.9% to $35.08 (32.65 euros) per megawatt (MWh) as of 10.35 a.m. GMT on Monday. Earlier in the trade, European gas prices rose by 4% at opening, after Norwegian operators on Saturday halted supply from the giant Troll gas field due to regular maintenance, and said maintenance was also being held at fields delivering gas into the Segal network for the UK. The lowered supply from Norway,…

Natural Gas Prices Forecast: Rising Ahead of EIA Data

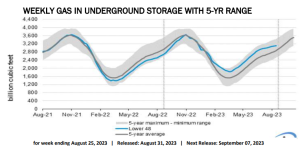

US natural gas futures are drawing close to a two-week high, driven by forecasts of escalating temperatures. Speculators are also eyeing a possible labor strike in Australia’s prominent LNG production facilities. Gains could be limited, however, by concerns about Hurricane Idalia’s potential demand destruction. Today’s EIA report has market predictions hovering around +30-31 Bcf. Notably, the past week saw temperatures higher than usual across the US,

excluding the Southwest & Northeast. A build of +24 Bcf is anticipated, a figure smaller than the five-year average. Last week, the gas in storage was noted at 3,083 Bcf, a net increase of 18 Bcf from the prior week, maintaining a margin above the historical five year range. Chevron Corp’s two Australian LNG facilities face potential work…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.