How Does Fuel Pricing Work?

In the ever-fluctuating world of fuel pricing, the simple act of filling up a tank holds a complex web of factors that determine its cost. Diesel, an essential resource for transportation and many other industries, bears a price that is shaped by a combination of economic, regional, and logistical influences.

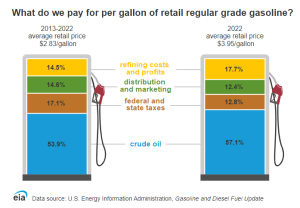

The price of a gallon of diesel is a blend of costs throughout the product’s journey from production to delivery. It can be divided into four primary components: the refinery’s procurement cost for crude oil, the expenses tied to the refining process, distribution and marketing, and last but not least, the taxes by federal, state, county, and local governments.

Undoubtedly, the most substantial slice of the price pie is the cost of crude oil itself. More than 50% of diesel prices were attributed to the cost of crude oil in 2022, which is highly influenced by supply and demand dynamics: when the offer of fuel surpasses the demand, prices tend to decline due to surplus. However, when demand exceeds supply, prices tend to go up.

Retail Prices

Retail prices include the amount consumers pay for diesel at the gas station. These prices are calculated by adding a retail markup and fuel taxes to the current wholesale diesel price. This markup is determined by retailers, who monitor market trends and set them accordingly. Factors such as local competition and market demand influence this markup, reflecting the retailer’s ability to optimize pricing at any given moment. Additionally, retail prices include fuel taxes, which fluctuate based on geographic location, spanning across different states and municipalities.

Wholesale Prices

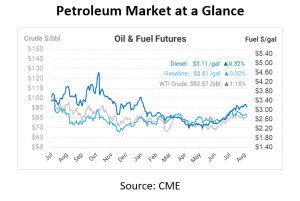

Wholesale prices are lower but more complicated, governed by how oil and diesel contracts are traded on commodity exchanges. Commodity exchanges are regulated financial markets where participants speculate on the future prices of oil and diesel, either betting on or de-risking their exposure.

In the US, the foundation of diesel pricing is the ultra-low sulfur diesel (ULSD) contract on the NYMEX division of the Chicago Mercantile Exchange (CME), along with other key domestic contracts like West Texas Intermediate (WTI) crude and RBOB gasoline. These contracts, traded in dollars per gallon, serve as the foundation for pricing. However, as different locations have distinct market dynamics, there are several key spot markets in the US where petroleum products are traded, including: New York Harbor, Gulf Coast, Chicago, West Coast, and the Mid-continent area known as Group 3, which includes states like Oklahoma and Kansas.

These markets are traded as differentials to the NYMEX ULSD price, translating the New York Harbor price into regional prices. Price reporting agencies such as S&P Global Platts then distribute these regional prices daily, forming the basis of wholesale pricing.

The wholesale price holds a dual purpose. Firstly, it helps wholesale diesel suppliers at distribution points (racks) in setting their daily diesel prices. This price is linked to the regional physical market and is the starting point for suppliers in different locations. Secondly, this price often acts as the foundation for contracts between wholesale buyers and sellers, with additional costs added. This system ensures that wholesale prices stay in sync with market realities.

Tracking Fuel Prices and Making Smart Decisions

For those keen on monitoring fuel prices, Mansfield Energy offers tools that will help you keep up to date. You can start right now by signing up for our FUELSNews.

As you already know, fluctuations in fuel prices are an inherent reality within the energy sector, influenced by uncertain factors such as weather conditions, pipeline disruptions, and refinery closures. However, With Mansfield Fuel Price Risk Management Services, you can stay prepared for unforeseen situations and minimize the financial repercussions of these occurrences on your fuel budget.

Mansfield Energy offers a range of options tailored to your needs. From simple fixed-price plans to price caps and collars, our team will design the best plan for you. Contact us today!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.