What is it – West Texas Intermediate (WTI)

You may have noticed in our FUELSNews Week in Reviews that we frequently provide a detailed analysis of various crude oil benchmarks, among which West Texas Intermediate, or WTI, is a regular feature. It is often juxtaposed with Brent Crude, another major benchmark in oil pricing.

The characteristics of their “lightness” and “sweetness” are desirable attributes in crude oil, as they make it simpler to refine. They define the benchmark for premium oils. Brent crude, which serves as a reference for approximately two-thirds of the world’s internationally traded oil supplies, is frequently regarded as the global benchmark for oil, thanks to its widespread adoption in futures pricing.

WTI crude oil holds a significant place as the U.S. benchmark for oil pricing. This unique crude type, derived from U.S. sources, is well-regarded for its quality and convenient refining properties. So, what exactly is WTI? Let’s find out.

What is WTI?

West Texas Intermediate (WTI), also known as Texas light sweet, is a type of crude oil used as a benchmark in oil pricing. It is sourced from the United States, primarily in Texas, Louisiana, and North Dakota. This specific grade is described as ‘light’ due to its relatively low density and ‘sweet’ because of its low sulfur content. Light sweet crude oil is desirable because it requires less refining and produces a high yield of high-value products like gasoline, diesel fuel, heating oil, and jet fuel.

Understanding What WTI Means

The WTI contract is based on the delivery of light sweet crude to Cushing, Oklahoma at a specific time in the future. We’ve covered before how futures markets work – the price reflected for WTI is not a current price, but rather the price of the product delivered in the “prompt” (upcoming) month at a certain time and place. In this case, the WTI differs from other crude grades that may be “heavier” (more dense) or “sour” (higher sulfur content).

The Cushing, OK delivery point was based on the Cushing Oil Field, discovered in 1912 and once a staple of American oil production. Today, the town is tiny, but is home to a vast interconnection of pipeline and storage for crude oil. While billions of dollars, representing millions of barrels, flow in and out of the NYMEX WTI contract, it’s based on a relatively small number of transactions of physical products delivered to this point. Platts and Argus Media both report on physical product costs in this market, informing speculators on costs.

WTI’s price is measured in barrels, which are 42-gallon increments. Trades on the NYMEX are typically sold in 1,000 barrel increments (42,000 gallons). Traders buying or selling WTI crude may be looking to speculate directly on crude oil, or they may be trading in conjunction with other products (refined products, Brent crude, etc) to bet on the differentials between them. Many oil producers also use the NYMEX as a hedging tool to lock in their profits for upcoming years.

Fun fact – “NYMEX WTI” is actually a double misnomer. As we covered before, the NYMEX was purchased by the CME in 2008, so really the crude contract is a CME contract. Second, WTI crude traded as a national benchmark is technically classified as Domestic Sweet or DSW, as noted by RBN Energy. Compared to oil truly created in West Texas (typically near Midland, TX), the DSW possesses broader, generally inferior quality specifications. Indeed, genuine Midland WTI, when delivered to Cushing, usually commands a substantial premium over the national “NYMEX WTI” benchmark due to these specification differences.

WTI Pricing Benchmarks

The significance of WTI pricing extends far beyond just the oil market. For one, the WTI price is a crucial global benchmark that sets the standard for pricing various types of crude oil worldwide. It serves as a reliable economic barometer; the fluctuations in WTI prices often mirror the overall health of the global economy. When economic conditions are favorable, the demand for oil products typically escalates, causing WTI prices to rise. Conversely, during economic downturns, decreased demand for oil generally results in lower WTI prices.

Beyond being a mere economic indicator, changes in WTI prices can offer valuable insights into future trends in the oil industry. This could encompass shifts in supply and demand, geopolitical factors, or technological advancements. Additionally, for businesses engaged in oil production, refining, distribution, or retail, WTI price changes can have profound implications on their operations. Depending on a company’s specific circumstances, an increase or decrease in prices could significantly impact costs and revenues, making WTI pricing an essential element in strategic business planning.

Why Does WTI Matter for Fuel Prices?

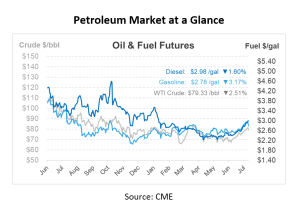

The price of crude oil is quite influential for fuel markets. Around 45% of diesel prices and 50%+ of gasoline prices is tied to the price of crude oil. But which crude oil?

If you live in Texas, it makes sense that the West Texas benchmark would be a good indicator for fuel prices. But consumers in California or New York may not see the correlations hold so well. Depending on where your fuel comes from, you may actually see fuel prices correlate more closely with Brent crude. This is especially true in coastal markets like the Northeast or the West Coast, which are often importing fuels from overseas or foreign crude for refining. In the Midwest and North Plains of the US, your price might be more linked to crude prices coming from Canada or the Dakotas, with only a portion coming from Texas crude oil. WTI prices are most important for fuel buyers directly supplied by Gulf Coast refineries – including the PADD 3 (Gulf Coast) states and PADD 1C (Southeast) markets.

Want to suggest a topic for What Is It Wednesday? Email the author, Sydney Casey, at scasey@mansfieldoil.com.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.