Week in Review – September 1, 2023

Crude futures are up $1/bbl today, marking their highest level in more than two weeks. This uptick followed China’s announcement of new economic easing measures aimed at stimulating its economy. The bullish trend represents the seventh day in a row of gains for crude, which is the longest such streak since January. While this upward movement generally signifies increasing costs at the pump, the silver lining is that these price levels could encourage producers to ramp up supply, potentially moderating prices over the long term.

The broader economic picture also suggests mixed signals; equity markets have increased while the U.S. dollar has weakened in response to China’s announcement. As for what’s next, all eyes are on the upcoming U.S. payrolls report, which could influence Federal Reserve decisions on interest rates. Federal Reserve Chairman Powell has indicated that monetary policy will be data-driven, making this report even more critical for future pricing dynamics.

OPEC+, led by Russia and other influential members, has agreed to additional reductions in crude exports. This comes as the industry anticipates whether Saudi Arabia will extend its existing one million barrels per day output cut into October. If these production cuts are sustained, it’s likely to exert upward pressure on oil and fuel prices.

State-side, U.S. crude stockpiles have dwindled to their lowest levels since last December, again indicating supply-side pressure on prices. Exports from the U.S. Gulf Coast dipped significantly in August due to reduced demand from Europe, even though there was a slight increase in Asian demand.

A Louisiana refinery, the third largest in the U.S., has resumed regular operations following a fire incident last week. The facility, with a crude processing capacity of 596 kbpd, had been operating at reduced rates, affecting the supply of refined products. Its return to full operational status could alleviate some supply constraints.

Prices in Review

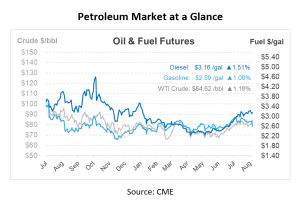

Crude prices opened the week at $80.15 before experiencing gains for the duration of the week. This morning, crude opened at $83.63, an increase of over $3 or 4.34%.

Diesel opened the week at $3.311 and saw up and down swings throughout the week. This morning, diesel opened at $3.1165, a decrease of nearly 20 cents or -5.87%.

Gasoline opened on Monday at $2.8658 and saw two days of drops before climbing back to $2.8127 on Thursday. This morning, gasoline opened at $2.5598, a decline of 30 cents or -10.68%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.