Natural Gas News – October 21, 2021

Natural Gas News – October 21, 2021

U.S. natgas futures edge up on cooler midday forecast

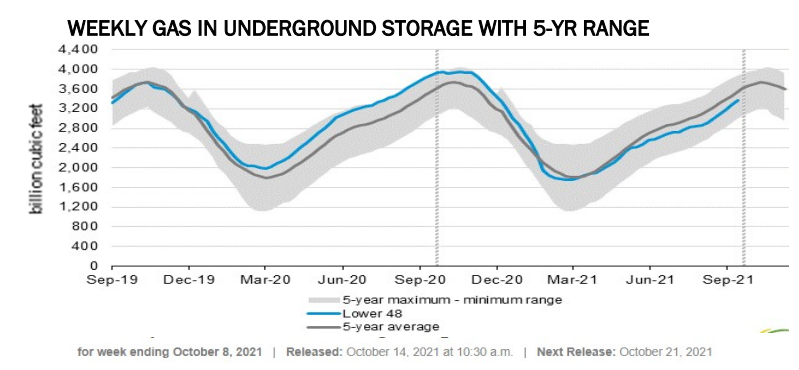

U.S. natural gas futures edged up almost 2% on Wednesday on midday forecasts calling for cooler weather and higher heating demand over the next two weeks than previously expected. Traders noted that prices fell to a near four-week low earlier in the day on early forecasts calling for the weather to remain warmer than usual over the next two weeks. Even with the cooler midday forecast, however, the U.S. weather is still expected to remain a milder than normal through early November. Two weeks ago, U.S. gas prices soared to their highest since 2008 on expectations global competition for liquefied natural gas (LNG) would keep demand for U.S. exports strong. But after weeks of mild weather, U.S. prices dropped about 25% amid growing belief that the United States will have more than enough gas in storage for the winter… For more info go to https://bit.ly/2XyXtVt

Mexico slows natural gas imports from US Southwest in favor of Texas flows

Additional pipeline capacity offers options for U.S. gas exports to Mexico. Cheaper and less volatile Waha Hub prices than Southwest US spot prices. Mexico has slowed gas imports from the southwestern United States in favor of getting more gas from Texas in October, pipeline nomination data shows. While some of the change is seasonal, expanded pipeline connectivity with Texas, including the Samalayuca-Sasabe and Wahalajara systems, has given network operators in Mexico more options and less exposure of importers to more volatile gas prices and expensive in the southwestern U.S. Gas exports to Mexico from the southwestern US, excluding West Texas, have averaged 570 MMcf / d so far in October, about 200 MMcf / d less than in September. At the same time, Texas exports increased 170 MMcf / d from last month to an aver… For more info go to https://bit.ly/3joRkCW

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.