Week in Review – October 22, 2021

This week oil headlines saw similar patterns of prices hitting multi-year highs. This came mostly with the fact of tighter supply around the world at a time when critical weather is making its way into the northern hemisphere. Lastly, this week we saw another inventory draw that sent fuel to new highs.

Along with prices hitting multi-year highs, as the situation with colder weather intensifies around the globe for fuel prices, it seems as if OPEC+ will not be extending a helping hand as they have not made any significant changes or announcements over the past two weeks. World leaders are also urging oil companies in their regions to consider ramping up the output or lowering prices completely. This could significantly impact prices going forward, but it is too soon to tell whether any of these companies will end up acting on their leader’s wishes.

This week government forecasters from the United States announced new developments for La Niña. La Niña usually brings warm and dry weather to the US while northern regions of the country experience colder-than-average winters. The forecasts suggest that heating oil demand could be strong later this year, which means more distillate demand and higher diesel prices. For diesel fleets, a chilly winter in the north also brings the possible for diesel fuel gelling in colder months if fleets are not prepared for the cold.

Lastly, on Wednesday we saw crude oil hit a new seven-year high. Along with climbing inflation and economic strength, fuel fundamentals point to an extremely tight supply picture. Although many headlines have pointed out market tensions, oil traders were expecting a relatively calm week. The consensus among traders was that crude inventories were moving higher, not lower. However, gasoline inventories fell more than twice as much as expected. This delivered a clear message – market fundamentals support the view that markets are tight, and prices should continue rising.

Prices in Review

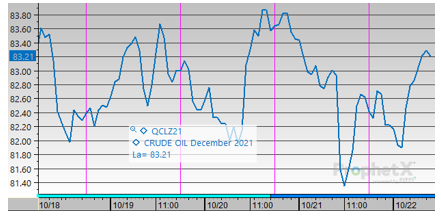

WTI Crude opened the week at $82.60. Prices were extremely volatile this week, with many changes day-to-day. Crude opened Friday at $82.61, an increase of $0.01 from Monday.

Diesel opened the week at $2.5719. Similar to crude, diesel was extremely volatile this week. It opened Friday at $2.5498, a decrease of $0.0221 from Monday.

Gasoline opened the week at $2.4795. Prices followed the volatile trends of crude and diesel this week. Gasoline opened Friday at $2.4749, a decrease of $0.0046.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.