Prices Reach Three Year High – But Not for Long

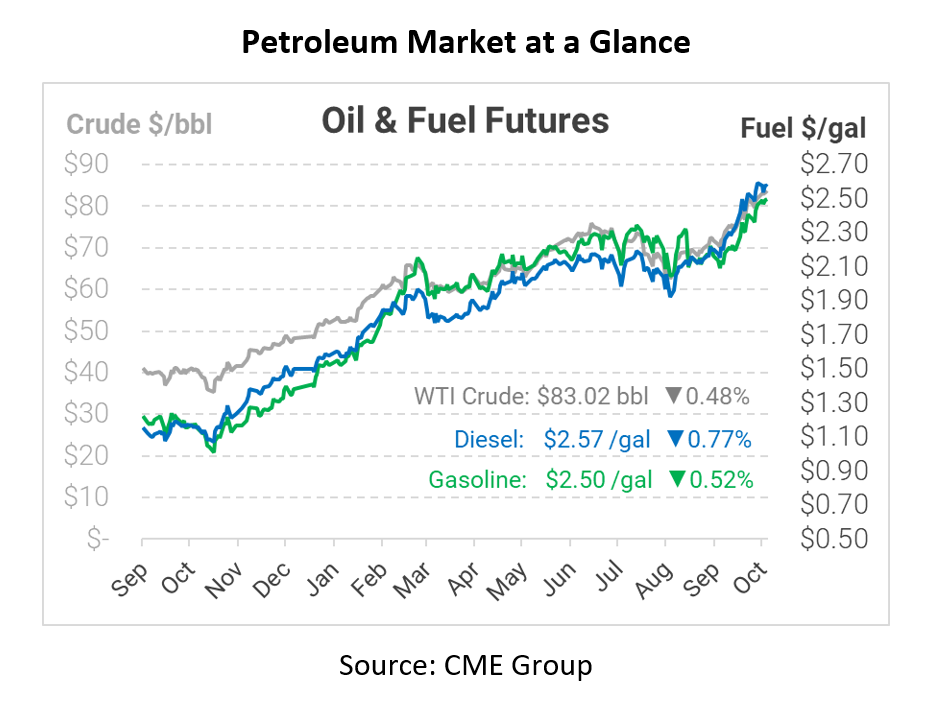

This morning oil made headlines after numbers showed prices reaching a new three-year high of $86. While this high price eventually retreated, it continues the highly volatile oil market trend that consumers have been accustomed to for some time now. This morning crude oil opened that day at $83.58, diesel at $2.5874, and gasoline at $2.5089.

This week we have seen trends of price increases associated with various factors. Today specifically, prices seemed to spike to a new three-year high based on the tight supply both domestically and abroad, along with a global energy crisis affecting far more than just crude oil. Specifically, the push toward a “greener” world is making things hard for oil, especially those larger oil giants specifically involved in output production such as OPEC+. This week we have also seen prices increase drastically based on the report that U.S. crude stockpiles are dwindling.

As OPEC+ continues to deliver additional oil to the market at a rate that is not ideal to many, we will continue to see a slow rebound. Data and analysts suggest that OPEC+ is unlikely to increase output anytime soon and will stick to their plan for gradual output increased over the next few months, all while demand will soon reach pre-pandemic levels. This rebound for market prices, supply, and demand will continue to be closely monitored as the country is about to deal with an entirely new pressing issue: the coldest winter in recent memory.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.