Price Tumble as Saudis Repair 50% of Outage

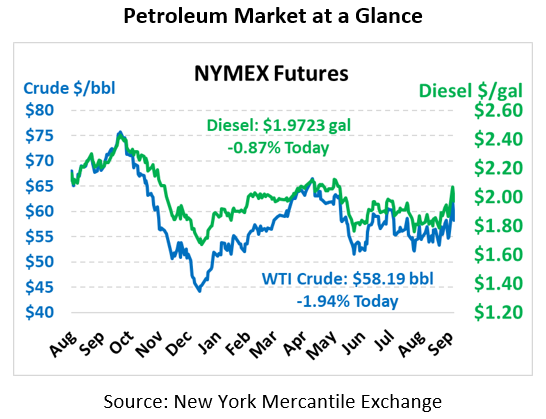

Prices plummeted yesterday following favorable news from Saudi Aramco on the production recovery effort. Prices fell back below $60/bbl, bringing it within its normal range again. Crude oil is currently trading at $58.19 this morning, down an addition $1.15.

Fuel prices are also lower, though their decline has been less than crude’s. Diesel prices are currently $1.9723, down 1.7 cents. Gasoline prices are $1.6474, down a more significant 2.8 cents.

Saudi Arabia held a press conference yesterday afternoon, and during the meeting the kingdom indicated that Saudi Aramco has already restored over half of its production, and the facilities will resume normal operations by the end of September. With the outage reduced, Saudi committed to maintaining exports by using their strategic reserves and activating idle capacity. While the worst of the situation is now past, markets are still antsy to see how the US and Saudi Arabia will react towards Iran.

With production resuming, markets are turning towards the US government for more stimulation. President Trump is expected to announce measures today that would prevent California from issuing stricter automotive efficiency standards. Because California’s consumer base is so large, auto manufacturers have had to keep up with their standards regardless of federal standards, but the EPA will be revoking California’s ability to set their own efficiency targets. For fuel prices, this may signal a slower advance towards engine efficiency, meaning more fuel consumption in the short-term.

Elsewhere, the Federal Reserve is beginning a two-day meeting on interest rates. Markets had previously expected at least a quarter-percent rate cut, but now sentiments are shifting towards leaving rates unchanged. A small cut would be supportive for financial markets including oil, while no change may be interpreted as slightly bearish.

The API’s data last night was the final source of market—driving news, though the report seems small compared to the massive headlines of the week. Petroleum inventories saw across-the-board builds, despite market expectations of falling crude and gasoline stocks. Today the EIA’s report will confirm whether the API is correct in its assessment of market conditions.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.