Continued Speculation over Saudi Attack

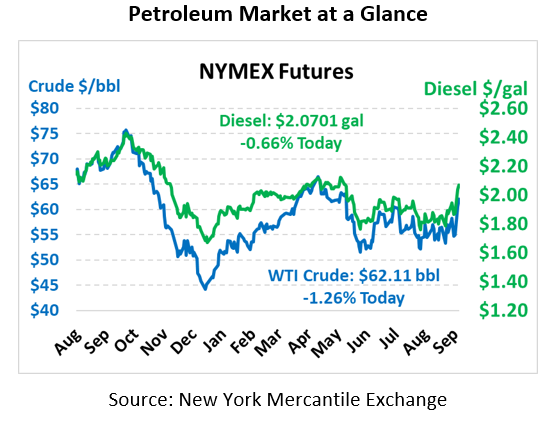

Oil prices have moderated a bit – though not a lot – following yesterday’s historic reaction to the attack on Saudi Arabian oil processing plants. Most of the major news was flushed out yesterday – large attack, Iran being blamed, long recovery time – so there isn’t much new action to move on. Yesterday ended in the largest price gain since Saddam Hussein invaded Kuwait, so continued gains would have been quite historic. It’s common for prices to fall after major up-days as traders take their gains and exit the market; however, a move lower today doesn’t necessarily imply prices won’t rise as the week continues. Crude oil prices are currently trading at $62.11, down 79 cents.

Fuel prices are mixed this morning, with diesel seeing larger losses than gasoline. Diesel prices are currently trading at $2.0701, down 1.4 cents from Monday’s close. Gasoline prices are currently $1.7517, unchanged from yesterday’s close.

The world’s eyes are on the Saudi conference today, which will be held at 1PM ET and hosted by Saudi Arabia’s new energy minister, Prince Abdulaziz bin Salman. Key questions will be the duration of the repairs and who Saudi Arabia believes is to blame. The country’s national oil company, Saudi Aramco, has been scrambling to acquire spot market supplies of crude and fuel to maintain its obligations to customers, putting a strain on international supplies.

On the repairs side, no official reports have been released but the unofficial expectation is for a prolonged recovery measured in weeks or months. While bringing all production back online may take a long time, Saudi Arabia will likely be able to bring at least some of their crude processing back online in the coming week or two. There are several ways world markets can meet the shortage – US swing production, OPEC loosening production quotas, emergency reserve releases, or even lifting sanctions on Venezuelan production. Given the circumstances, loosening Iran sanctions are probably off the table for now.

Most factors continue pointing to Iran as the culprit. Some missiles which crash-landed in the dessert have been identified as Iranian design, and the trajectory of the weapons suggest they came from the north (Iran) rather than the south (Houthi rebels in Yemen). Bahrain (to the northeast) reported seeing drones flying overhead before the attack, adding evidence that the attack was from a northern aggressor. Even if the attack originated in or near Iran though, there are questions whether it was a state-sponsored attack or done by a rogue group.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.