U.S. Increases Sanctions on Iran

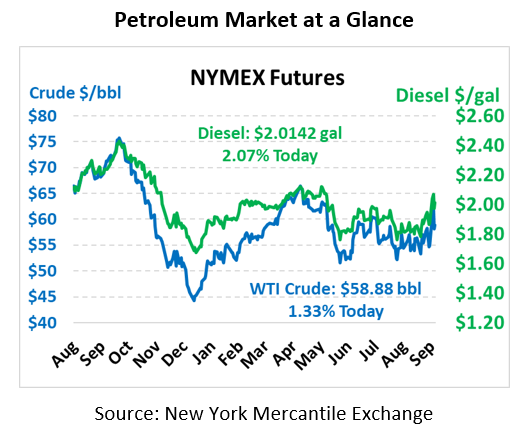

Oil markets are up this morning. WTI Crude is trading at $58.88, a gain of 77 cents.

Fuel is also up. Diesel is trading at $2.0142, a gain of 4.1 cents. Gasoline is trading higher at $1.6984, a gain of 4.1 cents.

After a volatile week in the oil markets, we are seeing some stabilization today as markets consider a smooth return of Saudi crude production. In response to the recent attacks on Saudi oil infrastructure, the U.S. announced increased sanctions on Iran. As markets weigh the geopolitical risk around this decision, we are seeing crude trading around 1% higher early on Thursday morning.

EIA reported a surprise build which was bearish news and drove markets lower on Wednesday. At Cushing, inventories fell for an 11th straight week as new pipelines carrying oil from the Permian to the Gulf Coast continue to alleviate the build-up in Cushing, which may help narrow the Brent-WTI spread further and push up fuel prices along the Southeast. Gasoline had a small surprise build versus an expected small draw. Diesel reported in line with expectations.

In Venezuela, we see PDVSA reducing crude oil blending and production due to swelling domestic inventories which have risen sharply since August to more than 38 MMbbls. PDVSA officials have said that “storage is almost at top capacity.” Venezuela’s crude storage capacity is about 65 MMbbls, but many tanks are off line due to lack of maintenance.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.