Natural Gas News – May 21, 2024

Natural Gas News – May 21, 2024

EU Gas Sendout From LNG Facilities Drops To 7-Month Low

EU gas sendout from LNG facilities has dropped to a seven-month low as reduced demand and healthy gas nominations weigh on LNG imports. Sendout levels from EU LNG hubs stood at 2,789 GWh/d May 18 and 2,797 GWh/d May 19, according to Gas Infrastructure Europe data — the lowest the bloc has seen since Oct. 8’s 2,710

GWh/d. Sendout was also down sharply on the year, averaging at 3,092 GWh/d for the first 19 days of May, 24% lower than 4,048 GWh/d during the same period last year. The low sendout levels are a sign of weak LNG demand in the region as current price levels and competition from the East is prompting market players to rely more heavily on gas. “I think it’s just a reflection of weak LNG demand,” David Lewis, LNG Analyst at S&P Global Commodity Insights, said. “Norwegian flows have remained robust and… For more info go to https://tinyurl.com/5n7j8hua

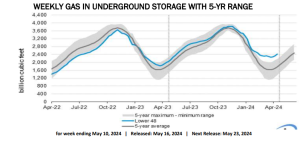

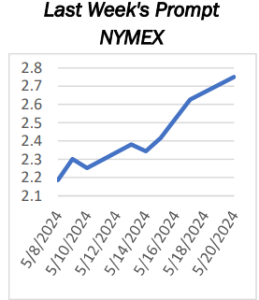

The Bullish Outlook for Natural Gas Continues to Improve

The fundamental outlook for natural gas has improved dramatically in recent months. The drop in production has brought total supplies back to much more favorable levels. However, prices have rallied hard in recent months and positioning is becoming stretched. We are also likely to see a production response from producers over the coming couple of months. These dynamics will likely put a cap on prices in the near-term. Looking forward into 2025, should we see US production growth disappoint come 2025 (my expectation), coupled with the continued rise in LNG export capacity, there appears plenty of upside for natural gas prices and equities over the coming 12-24 months. A colder than normal winter would only add fuel to the potential fire for a bull market in natural gas. Not only have front…

For more info go to https://tinyurl.com/37vec3n2

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.