Natural Gas News – April 18, 2024

Natural Gas News – April 18, 2024

Natural Gas News: Volatility Expected

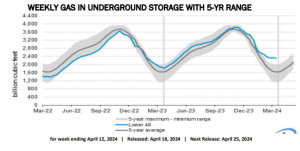

U.S. natural gas futures are experiencing a slight increase on Thursday, amid anticipation of the latest Energy Information Administration (EIA) storage report, expected to show a build in reserves. This report comes at a critical time when weather patterns and demand factors are influencing market trend significantly. At 12:26 GMT, Natural Gas futures are trading $1.770, up $0.006 or +0.34%. The anticipated EIA weekly storage report is expected to show an increase of about 51 billion cubic feet (Bcf), which is lower than the five-year average of 61 Bcf. This relatively light build is attributed to above-normal temperatures across most regions, except the West, and robust wind energy generation. In recent sessions, natural gas futures have shown volatility, dropping approximately 3% to a three-week low due to mild… For more info go to https://tinyurl.com/2henasrw.

Natural Gas Prices Drop as Market Continues to See Pessimism

The U.S. Energy Department’s weekly inventory release showed that natural gas supplies increased more than expected. The bearish inventory numbers, together with weaker weather-related demand, affected natural gas futures, which settled with a small loss week over week. In fact, the market hasn’t been kind to natural gas, with

the commodity recently hitting nearly four-year lows due to worries about record output and concerns about a growing glut. At this time, we advise investors to focus on stocks like Coterra Energy CTRA and Cheniere Energy LNG. EIA Reports a Build Larger Than Market Expectations Stockpiles held in underground storage in the lower 48

states rose 24 billion cubic feet (Bcf) for the week ended Apr 5, above the guidance of a 9 Bcf addition, per a survey conducted by S&P… For more info go to https://tinyurl.com/296kay7v

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.