Week in Review – April 19, 2024

Reported Israeli retaliatory actions against Iran pushed oil prices higher in the overnight session, yet WTI is down 52 cents at $82/bbl this morning. Crude oil futures did not fluctuate much yesterday, with the benchmark crude contracts showing minimal changes between losses and gains. The May WTI contract increased by 4 cents to close at $82/bbl, while the June Brent contract declined by 18 cents to $87/bbl. Since Monday, prices have dropped by over 4%, marking the largest weekly decline since the beginning of February.

In related developments, U.S. legislators are incorporating sanctions targeting Iran’s oil exports into an upcoming Ukraine aid bill. These sanctions focus on any entities handling Iranian crude, including ships, ports, refineries, and transactions involving Chinese financial institutions and Iranian petroleum purchases.

The US has reimposed oil sanctions on Venezuela after the Department of State allowed a six-month waiver that permitted Venezuela to trade its crude freely to lapse. The decision came as a response to President Maduro’s failure to meet pre-election promises. Oil companies have been given a 45-day grace period to cease their operations in Venezuela.

The National Economic Advisor to the Biden administration, Lael Brainard, emphasized their commitment to keeping gas prices manageable this summer. When questioned about potentially tapping into the Strategic Petroleum Reserve, Brainard reassured that measures would be taken to ensure affordability. Meanwhile, prompt gasoline futures have increased approximately 29% since the beginning of the year, with average pump prices reaching $3.67 per gallon, as reported by AAA.

Goldman Sachs is maintaining a projected $90/bbl ceiling for Brent in scenarios without geopolitical disruptions affecting supply. They attribute this to considerable spare capacity and the likelihood of increased production by OPEC+ in the third quarter, stable inventory levels over the past year, and market-stabilizing responses such as higher OPEC exports and decreased crude demand from the U.S. Strategic Petroleum Reserve and refineries. Nonetheless, Goldman Sachs has raised its minimum price expectation for Brent from $70 to $75, citing an improved influence of OPEC on market sentiment and a slight increase in their base price forecast by $1 to $2. They now anticipate a slow return to normal in the risk premium and expect OPEC to maintain higher spot prices relative to futures by moderately reducing production cuts. Overall, they see the risks to their pricing trajectory as slightly more likely to push prices up, with potential downward pressures from extended OPEC+ cuts or geopolitical tensions.

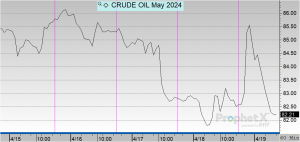

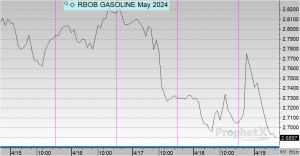

Prices in Review

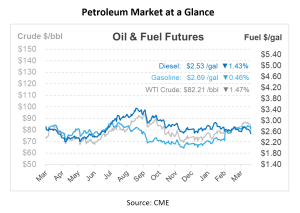

Crude oil opened the week at $85.93 and saw declines for the rest of the week. This morning, crude opened at $82.62, a decline of $3.31 or -3.85%.

Diesel opened the week at $2.70 and also saw decreases for the rest of the week. This morning, diesel opened at $2.5347, a decline of 16 cents or -6.12%.

Gasoline opened the week at $2.81, 11 cents above diesel, and saw marginal up and down swings throughout the week. This morning, gasoline opened at $2.7065, a drop of 10 cents or -3.68%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.