Natural Gas News – February 27, 2024

Natural Gas News – February 27, 2024

Natural Gas News: Facing Volatility

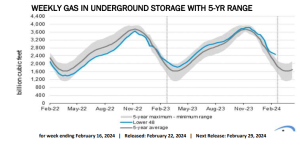

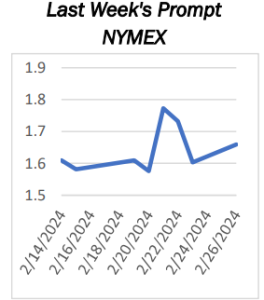

U.S. natural gas futures are experiencing a downturn on Tuesday, with prices dropping below last week’s low of $1.522. This decline effectively erases the gains spurred by Chesapeake’s recent announcement of planned production cuts for 2024. Current market movements reflect traders’ responses to recent developments in Europe and the impending expiration of the March futures contract. At 13:59 GMT, Natural Gas futures are trading $1.796, up $0.052 or +2.98%. The outlook for natural gas prices is currently constrained, primarily due to the unusually mild winter in the United States, which has led to reduced heating demand and increased supplies. Maxar Technologies forecasts significant warmth in the Midwest and eastern U.S., further impacting demand. Natural gas prices have hit a 3-1/2 year low, exacerbated by high … For more info go to http://tinyurl.com/yr7evzyt

Natural Gas Turns Flat Ahead Of US Trading

Natural Gas (XNG/USD) is switching to the downside after being up nearly all morning in European trading. The sudden change of heart by traders comes after comments from French President Emmanuel Macron could quickly defused by German Prime Minister Olaf Scholz and NATO Secretary General Jens Stoltenberg saying that European

boots on the ground is not an option. This means the situation in Ukraine is not about to escalate further with NATO remaining sidelined. The US Dollar (USD) is facing a slight blow, with a basket of currencies all advancing against the Greenback. The charge is being led by the Japanese Yen, which is up near 0.50% against the US Dollar. US Traders are bracing for Durable Goods numbers and some confidence indicators later in the US session to be released. Russian gas… For more info go to http://tinyurl.com/ycjnn36n

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.