Natural Gas News – February 22, 2024

Natural Gas News – February 22, 2024

Natural Gas Prices Forecast: Traders Bracing

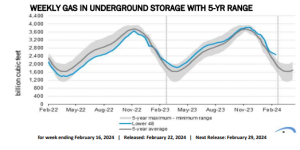

U.S. natural gas prices are experiencing a downturn on Thursday, unable to sustain the upward movement seen on Wednesday. The market’s attention is now sharply focused on the upcoming U.S. Energy Information Administration (EIA) storage data, with traders preparing for potential volatility. The price increase on Wednesday

was largely influenced by Chesapeake Energy’s announcement of a production cut in 2024 due to low gas prices. At 12:23 GMT, Natural Gas futures are trading $1.731, down $0.042 or -2.37%. Traders are bracing for today’s EIA storage report, with market expectations pointing towards a draw of approximately -65 Bcf, significantly less

than the five-year average draw of -168 Bcf. This forecast is in line with the warmer-than-normal conditions across most of the U.S., except for some areas in the West.… For more info go to http://tinyurl.com/2cf73zjn

Natural Gas: Prices Could Test Last Year

Demand for natural gas in Europe is falling, and a peak in LNG prices is on the horizon. Warmer-than-expected winter, and increased supply diversification favor price declines as well. As a result, bears could be targeting the lows near the 20 euro price level. In 2024, invest like the big funds from the comfort of your home with our AI powered ProPicks stock selection tool. Learn more here>> Europe can breathe a sigh of relief as indications suggest that the continent might not face supply issues in the next winter. The gas market reflects this situation, with the Dutch TTF futures trending downwards towards last year’s lows, which lies just above 20 euros per MMBtu. A warm second part of the heating season and forecasts of relatively high temperatures in the coming months further favor… For more info go to http://tinyurl.com/548nfkp9

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.