Week in Review – February 23, 2024

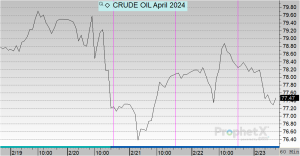

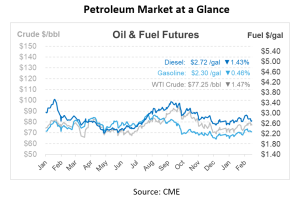

Energy markets experienced a mixture of fluctuations this week influenced by shifts in crude oil, diesel, and gasoline inventories alongside refinery operations. This morning, prompt crude futures experienced a downturn, sitting at $77.25/bbl. This reversal erases yesterday’s gains and positions the market for a weekly decline of over $1/bbl. Yesterday’s session closed on a higher note with a 70-cent increase per barrel, buoyed by strength in refined products.

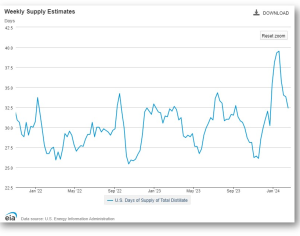

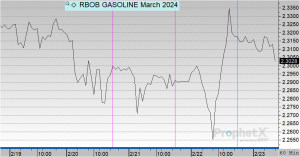

The latest inventory reports from the Energy Information Administration (EIA) have highlighted a fifth week of declining diesel stocks, attributed to increased diesel exports and lower-than-average refinery operations. However, there’s a positive shift as refinery rates are leveling off, hinting at a potential steady rise in operations within the next three to six months. This improvement is expected as refineries resume activity after scheduled maintenance and as facilities like Whiting bounce back from unexpected shutdowns. The EIA noted a significant drop in US diesel inventories by 4 million barrels, the most considerable decrease since early May of the previous year. US gasoline inventories have also fallen to their lowest since early January, even as refinery operations remain stable at 80.6%, amid ongoing refinery outages.

Regionally, the East Coast (Padd 1) is grappling with historically low inventory levels, maintaining a state of backwardation in the market. This situation underscores the prevalence of “just in time” inventories across many parts of the country, which, despite potentially appearing negative or flat on paper, reflects the challenges in securing reliable supply from low rack inventories due to unplanned disruptions.

In contrast, the crude stockpile saw an increment of 3.5 million barrels this week, a figure slightly less than the American Petroleum Institute (API) had anticipated. The April 2024 versus May 2024 WTI prompt spread increased by 8 c/bbl day-over-day, reflecting optimistic US crude demand forecasts as several refineries are expected to resume operations after maintenance shutdowns.

Prices in Review

With trading closed on Monday for Presidents Day, crude futures opened at $78.98 on Tuesday. Prices dipped slightly on Wednesday and traded back up on Thursday. This morning, crude opened at $78.37, a decrease of 61 cents or -0.77%.

Diesel opened the week at $2.8066 before dipping on Wednesday and Thursday. This morning, diesel opened at $2.7472, a decrease of about 6 cents or -2.12%.

Gasoline opened the week at $2.3309 and experienced slight declines on Wednesday and Thursday. This morning, gasoline opened at $2.3294, a decrease of 1 cent or -0.06%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.