Natural Gas News – January 25, 2024

Natural Gas News – January 25, 2024

What Caused the Collapse in Natural Gas Prices Last Week?

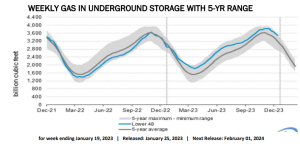

The U.S. Energy Department’s weekly inventory release showed a lower-than-expected decrease in natural gas supplies. The bearish inventory numbers, together with predictions of weaker weather-related demand in late January, weighed on natural gas futures, which settled with a heavy loss week over week. In fact, the market hasn’t been kind to natural gas, with the commodity trading considerably lower over the past 12 months due to growing worries about record output and concerns about an ongoing supply glut. At this time, we advise investors to focus on stocks like Range Resources RRC, Coterra Energy CTRA and Cheniere Energy LNG. Stockpiles held in underground storage in the lower 48 states fell 154 billion cubic feet (Bcf) for the week ended Jan 12, below the analyst guidance of some 165 Bcf withdrawal. The decrea… For more info go to http://tinyurl.com/3s8zv44z

Natural Gas Prices Forecast: Oversold Conditions

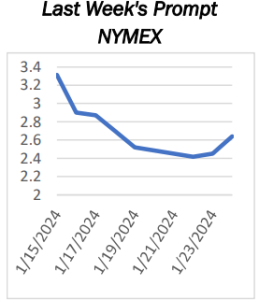

U.S. natural gas futures are trading higher on Wednesday after gapping on the opening. The move is being primarily driven by a combination of short-covering and oversold technical conditions, alongside domestic supply and demand factors. At 12:42 GMT, Natural Gas futures are trading $2.529, up $0.079 or +3.22%. The market’s upward movement is likely a short-covering rally, fueled by technical conditions that suggest an oversold market. This scenario typically leads to a temporary surge in prices as traders cover their short positions. Changing weather patterns, particularly the warmer-than-average conditions expected across most of the U.S., are influencing LNG demand. Despite this, colder weather is forecasted to enter the western U.S. by early February, potentially affecting

future deman… For more info go to http://tinyurl.com/ze7rf2kj

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.