Week in Review – January 26

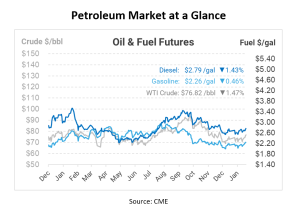

Oil prices are showing signs of a weekly gain driven by optimism surrounding the U.S. economic growth and ongoing stimulus efforts in China, raising expectations for increased crude demand throughout the year. Despite a minor dip in prices on Friday morning, with the West Texas Intermediate (WTI) declining to $76.86 per barrel and the Brent dropping 71 cents, both US crude and the global benchmark are set to conclude the week with gains exceeding 4%. These trends suggest a promising outlook for the oil market in the coming months.

One of the factors influencing crude prices is the escalation of geopolitical tensions. Reports of attacks on ships in the Red Sea by the Iran-backed Houthis and China’s call for Iran to rein in these attacks sent shockwaves through the industry. These attacks disrupted a vital trade route between Asia and Europe, raising concerns about potential disruptions in the oil supply chain.

The tension escalated further with an attack on a refinery along Russia’s Black Sea coast, which added to concerns about the stability of global energy supplies. This event followed a series of attacks on Russia’s downstream and energy-export facilities, contributing to a surge in crude prices.

Adding to the price volatility, Iranian crude exports were significantly reduced from as much as 3 million barrels per day to approximately 1 million barrels per day due to US sanctions on the country’s oil exports. This reduction in supply further intensified upward pressure on crude prices.

Crude prices were also influenced by a supportive macroeconomic environment. Equities posted gains, and the US Bureau of Economic Analysis estimated an annualized growth rate of 3.3% for the last quarter, significantly surpassing the consensus forecast of 2%. These positive economic signals boosted demand expectations for oil.

As the week unfolded, the Mar24/Apr24 WTI spread closed 6 cents per barrel higher at +17 cents per barrel, indicating tightening expectations for the near-term US crude balance. Additionally, US Gulf Coast diesel exports to Europe reached a January record, reflecting Europe’s increased reliance on the US to compensate for falling supply caused by shipping challenges in the Red Sea.

In the midst of these price fluctuations and geopolitical tensions, it was announced that OPEC+ was unlikely to make any changes to oil output policy at its upcoming monitoring meeting on February 1st. Saudi Arabia and its allies had recently initiated production cutbacks but required more time to assess their impact. The group planned to review last year’s production levels at the meeting, with no immediate plans to issue policy recommendations. This decision will have significant implications for global oil supply and prices.

Prices in Review

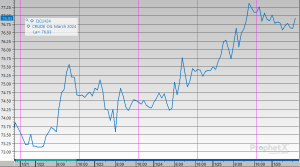

Crude oil experienced a positive week, with gains seen throughout the five trading days. It opened at $74.28 on Monday and gradually increased over the course of the week. By Friday, the price had risen to $76.97, reflecting an increase of $2.69 or 3.6%

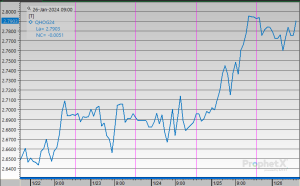

On Monday, Diesel opened at $2.6582, saw an increase to $2.6806 on Tuesday, and continued to rise steadily throughout the week. This morning, diesel opened at 2.7894, marking a difference of $0.1312 dollars or approximately 4.94%.

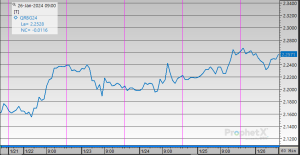

On Monday, gasoline opened at $2.2052, followed by a slight increase to $2.2184 on Tuesday and a subsequent decrease to $2.2093 on Wednesday. However, the trend shifted on Thursday when prices rose to 2.2361. The upward trajectory continued into Friday when the price reached 2.2618, marking a gain of $0.0566 or 2.57%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.