Natural Gas News – October 3, 2023

Natural Gas News – October 3, 2023

Natural Gas Prices Forecast: El Nino Looms

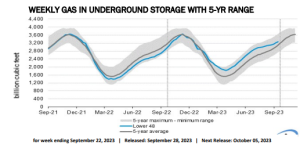

Despite a brief uptick in prices, the U.S. natural gas market is grappling with bearish undercurrents. This comes on the heels of Monday’s 3% decline in futures, as milder winter forecasts continue to dilute demand expectations. Even record exports to Mexico and a reduced gas output haven’t been enough to quell the downward pressure. Adding to this bearish sentiment is the rising possibility of a mild El Nino winter, which has market speculators wary of the months ahead. The industry’s March-April 2024 spread, colloquially known as the “widow maker,” has hit a record low, signaling the market’s anticipation of a less severe winter. This directly impacts the amount of gas expected to be drawn from storage facilities, adding another layer of complexity to the market’s movements. LSEG data reveals a subtle decline in… For more info go to

https://shorturl.at/pPQV1

Saudi Arabia Finally Joins the Natural Gas Wave

The world’s biggest oil producer is finally moving to grab a piece of the booming natural gas market, the latest proof that the industry expects the fuel to play a significant part in the energy transition. In a strategic shift, Saudi Aramco agreed to buy a stake in MidOcean Energy, marking its first investment in liquefied natural gas.

MidOcean is in the process of acquiring interests in four Australian LNG projects and is also part of a consortium to buy Sydney-based Origin Energy Ltd. Other investments may be on the horizon. Aramco’s Upstream President Nasir Al-Naimi said in an email Sunday the company is looking for more acquisitions. Officials have been in talks with exporters in the US this year, according to people with knowledge of the matter. The Saudi company has been trying to… For more info go to https://shorturl.at/ejmFN

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.