US Dollar Peaks as Crude Retreats from Weeks of Hefty Gains

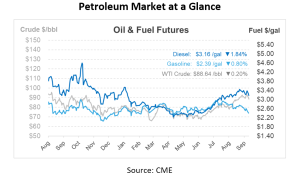

Recent upward trends for crude futures seem to be retracing steps as oil futures are down this morning by nearly 20 c/bbl, reversing the gains seen over the last few weeks. Yesterday, crude prices closed approximately $2/bbl lower, corresponding with an inflated US dollar and declining equity futures. The November West Texas Intermediate settled at $88.82/bbl on Monday, retracting a significant $1.97/bbl from the gains made in the third quarter of the year. Brent crude, too, with its December contract, recorded a decline of $1.49 to stand at $90.71/bbl.

On Monday, the US dollar hit a 10-month high once again against other major currencies as the US government sidestepped a partial shutdown, and economic indicators suggested a prolonged phase of interest rate hikes from the Federal Reserve, which would ultimately halt economic expansion.

OPEC+ convenes for a ministerial panel on Wednesday, October 4. Questions remain as to whether Saudi Arabia and Russia will uphold their voluntary output cut, currently set at 1.3 million bpd. These supply cuts have led crude prices to rise 20% over the past few months. Hints from the UAE Energy Minister suggest that the existing production cuts may well stay, terming it the “right policy.” With global oil markets on OPEC+’s radar, there’s no evident intent to temper the momentum driving prices close to the $100/barrel mark.

International oil buyers are witnessing some of the steepest supply premiums seen in months, influenced by diminishing reserves at the prime US storage facility in Cushing, Oklahoma. This storage facility plays a central role in determining oil prices across the Americas and beyond. Alarmingly, its current stock levels are reminiscent of the seasonal lows from 2014, which coincide with the global supply constraints due to reduced output from major producers.

Recent trends saw the US step up to bridge the supply gap, exporting over 4 million barrels daily to cater to international demand. But with domestic reserves depleting rapidly, questions arise about the continuity of this supply trend. Alarmingly, current stock levels are in line with some of the lowest levels seen in the last decade, in line with the dips seen in 2014, 2018, and 2022, which coincide with the global supply constraints due to reduced output from major producers.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.