Natural Gas News – September 21, 2023

Natural Gas News – September 21, 2023

US NatGas Prices Up 2% To Two-Week High On Daily Output Drop

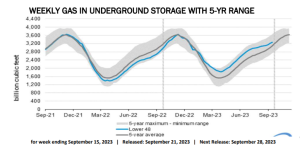

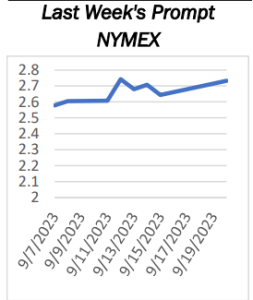

U.S. natural gas futures climbed about 2% to a two-week high on Tuesday with a drop in daily output and as the amount of gas flowing to the country’s liquefied natural gas (LNG) export plants increases after Freeport LNG’s facility in Texas returned to near full service over the past few days. That price increase came despite forecasts for

milder weather and lower gas demand over the next two weeks than previously expected. Front-month gas futures NGc1 for October delivery on the New York Mercantile Exchange rose 6.4 cents, or 2.4%, to $2.792 per million British thermal units (mmBtu) at 8:48 a.m. EDT (1248 GMT), putting the contract on track for its highest close since Aug. 30. Looking ahead, the premium on March 2024 futures over April 2024 NGH24-J24, which the industry calls the widow maker, slid to around 24… For more info go to https://shorturl.at/frBJ2

US Is Top Exporter Of Liquified Natural Gas In First Half Of 2023

The U.S. exported more natural gas in the first six months of 2023 than in any other previous six-month period, the U.S. Energy Information Agency reported. U.S. companies averaged 12.5 billion cubic feet per day (Bcf/d) in the first six months of this year, an 11% increase from their average over the same period last year. This is after in May of this year, the U.S.’s “net natural gas exports as liquefied natural gas (LNG) and by pipeline averaged a monthly record

high of 13.6 Bcf/d.” It’s also after the U.S. in 2017 became a net exporter of natural gas for the first time since 1957, “primarily because of increased LNG exports,” the EIA says. The U.S. became a net exporter after Cheniere Energy was the first to export domestically sourced LNG from the Sabine Pass LNG Terminal in Camero… For more info go to https://shorturl.at/gjIW7

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.