Week in Review – September 22, 2023

Crude futures are up this morning, largely spurred by heightened demand for crude products and a significant dip in China’s crude inventories. The latter now stands at 1.1 billion bbls, its lowest since mid-June. There is a mild inconsistency in the market trend: crude prices experienced some slowdown this week. This marginal slump contrasted with the preceding week’s rally, which saw highs of $91.1/bbl for WTI and $94.6/bbl for Brent.

The Federal Reserve, in its Wednesday announcement, decided to maintain the status quo on interest rates. A discernible hawkish shift has stirred concerns regarding the potential impact on economic growth. These fears were exacerbated after the FOMC meeting, especially since the Fed exhibited an even stronger hawkish inclination than anticipated. There is also an ongoing discord among House Republicans over government spending decisions raising further economic worries, notably around potential repercussions on fuel demand.

Goldman Sachs posted some important updates regarding their projections this week. The group has now postponed its forecast for the inaugural rate cut, shifting it from the second quarter of 2024 to the fourth quarter of the year. Nonetheless, they are not forecasting any supplementary rate hikes. GIR has significantly revised its Brent forecast for the next 12 months, bumping it up from $93/bbl to $100/bbl. This adjustment comes in light of anticipated sharp inventory drawdowns due to decreased OPEC+ supply juxtaposed with heightened demand.

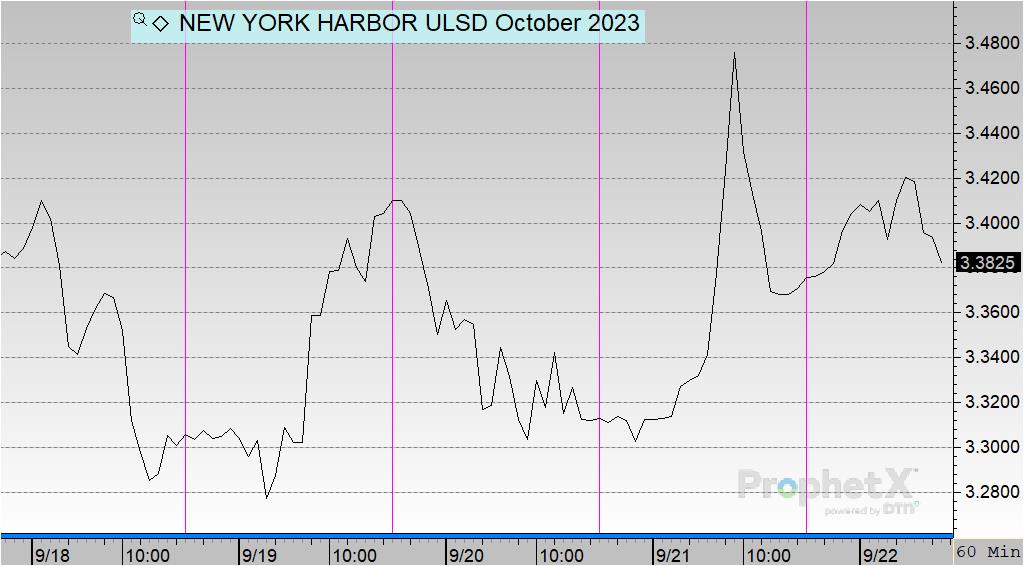

Diesel prices are also witnessing an uptick, trading higher by approximately 4c/gal on Thursday, attributed to global supply apprehensions. Supporting this concern, data from China indicates a 2.5% reduction in diesel stocks to 16.5 million tons and a 1.2% reduction in gasoline stockpiles to 12.9 million tons, all within a week. The Energy Information Administration’s latest report hints that the rally in ULSD futures might persist, especially in light of a significant 2.9 million bbl reduction in U.S. distillate inventories.

A federal judge has mandated the Biden administration to broaden its Gulf of Mexico oil lease sales. Despite attempts by the Interior Department’s Bureau of Ocean Energy Management to minimize the sale territory to protect an endangered whale species, the judge opined that the department’s shift lacked ample justification. This verdict was influenced, in part, by arguments from a Louisiana-based judge who highlighted potential state losses amounting to $2.2 million in royalties.

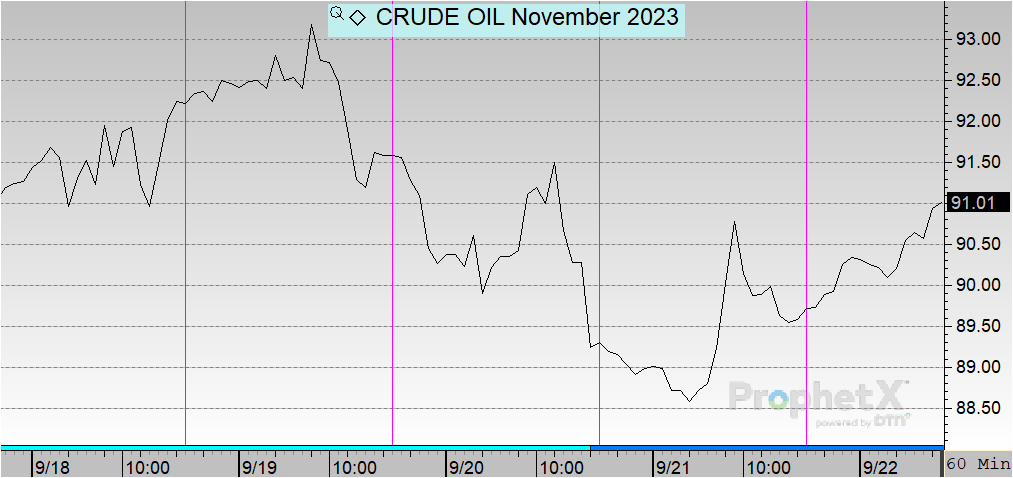

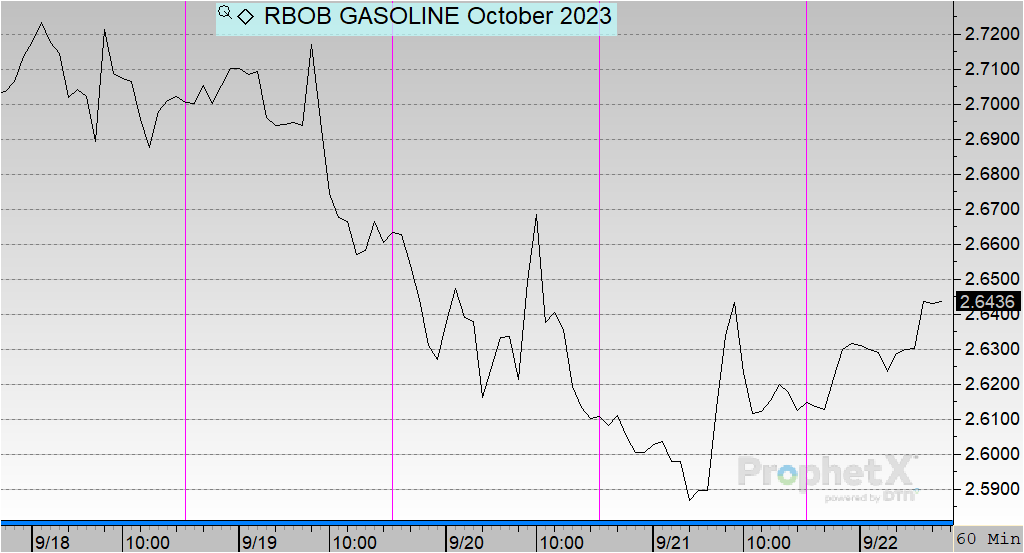

Prices in Review

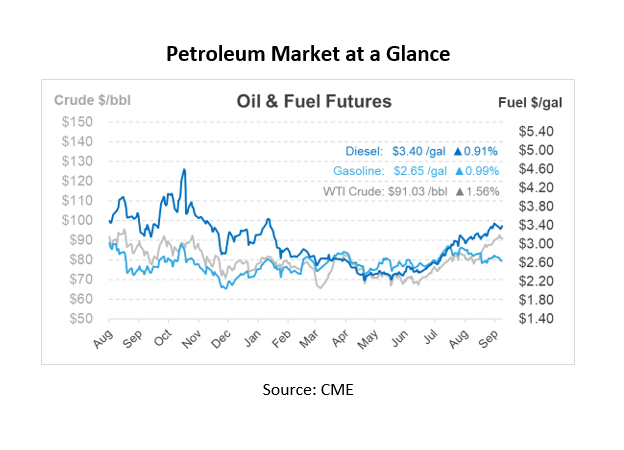

Crude opened on Monday at $91.20 and rose over $1/bbl on Tuesday before retreating for the remainder of the week. This morning, crude opened at $89.62, a decline of $1.58 or -1.732%.

Diesel opened the week at $3.3966, experienced a drop on Tuesday, and increases until today. This morning, diesel opened at $3.3682, a decline of nearly 3 cents or -0.836%.

Gasoline opened the week at $2.7101 before experiencing steady declines. This morning, gasoline opened at $2.6166, a decrease of almost 10 cents or -3.634%.

This article is part of Daily Market News & Insights

Tagged: Biden, China, crude prices, demand, diesel, eia, fuel prices, gasoline, Inventories, oil prices, Russia, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.