Natural Gas News – September 5, 2023

Natural Gas News – September 5, 2023

Natural Gas Prices Forecast: Demand Slumps

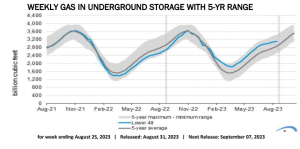

Natural gas futures faced a dip for the second consecutive session on Tuesday. The underlying reasons seem multifaceted, encompassing potential bearish weather forecast changes and reduced demand from Europe. Such influences appear strong enough to overshadow potential bullish factors, such as limited supply from Norway and the looming strike in Australia. Despite the decreased supply from Norway and threats of strikes at the Australian LNG facilities, European gas demand remains tepid. Dutch and British gas prices have seen declines, attributed mainly to high gas inventories and weak European demand. Europe’s gas storage sites are currently operating at over 93% capacity, as per data from Gas Infrastructure Europe. This ample supply has been further supplemented by reduced demand, thanks to high temperatures across…

Natural Gas Losing Steam With The Demand Side Absent

Natural Gas ekes out more losses as European gas futures are sinking lower by nearly 5%, while US gas futures are trying to keep losses contained. The supply side is starting to see a bottleneck with several gas fields in Norway suddenly halting production in unforeseen maintenance. Meanwhile, big buyer Europe is showing less interest,

less demand, as the strategic gas stockpiles are nearly fully ahead of winter and ahead of target. Meanwhile, the US Dollar is starting to eat into its gains from Friday. With the US bond market closed for the Labor Day holiday in the US, the Greenback lacks one of its main drivers. Add to that the risk on tone in European and Asian equities, and the US Dollar index (DXY) is trading in the red, though at a minor loss around 104.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.