Natural Gas News – May 25, 2023

Last Week Was a Good One for Natural Gas Market: This Is Why

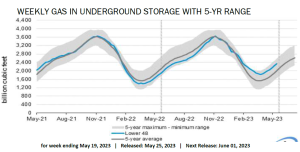

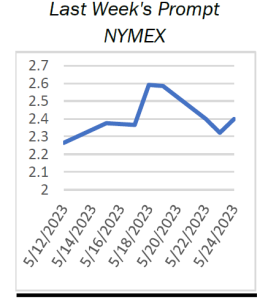

The U.S. Energy Department’s weekly inventory release showed a lower-than-expected increase in natural gas supplies. Following the positive inventory numbers, futures rose more than 14% week over week. Another factor to be noted in last week’s sudden spike is the hint of tightening supply. Despite all this, the market hasn’t been kind to natural gas in 2023, with the commodity trading considerably lower year to date and briefly breaking below the $2 threshold for the first time since 2020. As tepid weather-related demand continues to impact the commodity’s demand, we advise investors to focus on stocks like SilverBow Resources SBOW and Cheniere Energy LNG. Stockpiles held in underground storage in the lower 48 states rose 99 billion cubic feet (Bcf) for the week ended May 12…

The Intensity of Methane Emissions from Oil and Gas Sector Has Declined, Study Finds

The intensity of methane and greenhouse gas emissions from the oil and gas sector declined 28% and 30%, respectively, between 2019 and 2021 among the largest producers in the country, despite an increase in natural gas production, according to an analysis published by the nonprofits Clean Air Task Force and Ceres. The report, which assessed the production-based emissions of more than 300 U.S. producers, found that the methane emissions intensity of natural gas production and the greenhouse gas emissions intensity of oil and gas production vary dramatically across companies. Natural gas producers in the highest quartile of methane emissions intensity have an average emissions intensity that’s nearly 26 times higher than …

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.