Week in Review – May 26, 2023

Crude markets enjoyed some backing today, bolstered by a depreciating dollar and a buoyant equity market, incited by encouraging news about the progress made on the US debt ceiling negotiations. Market participants will have their eyes trained on forthcoming US economic reports, as they could potentially hint at prospective rate increments during the Federal Reserve’s June assembly.

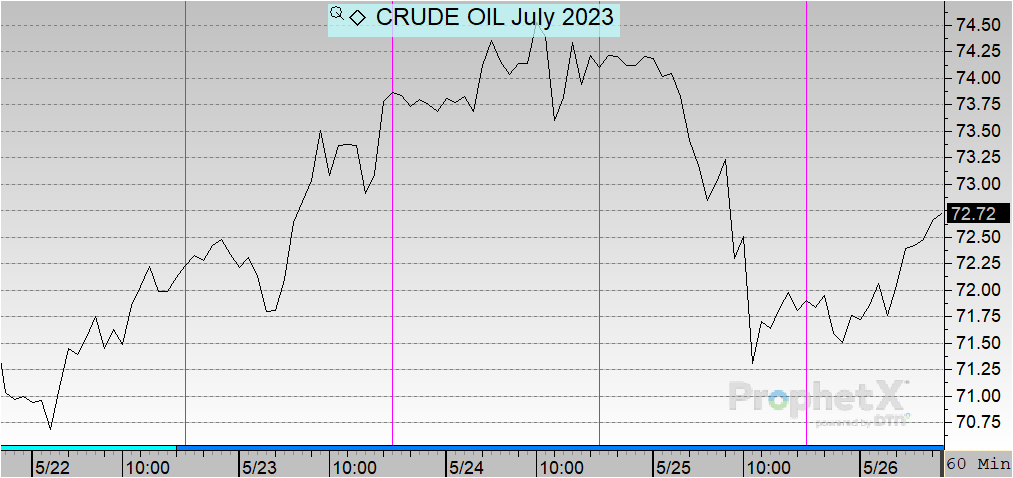

Earlier today, prompt oil futures experienced a surge of over 50c/bbl, lining them up for a weekly increase of around 1%, despite a significant slump of over $2/bbl just the day before. These price oscillations were largely dictated by overarching macroeconomic conditions, with the US debt conundrum playing a crucial role.

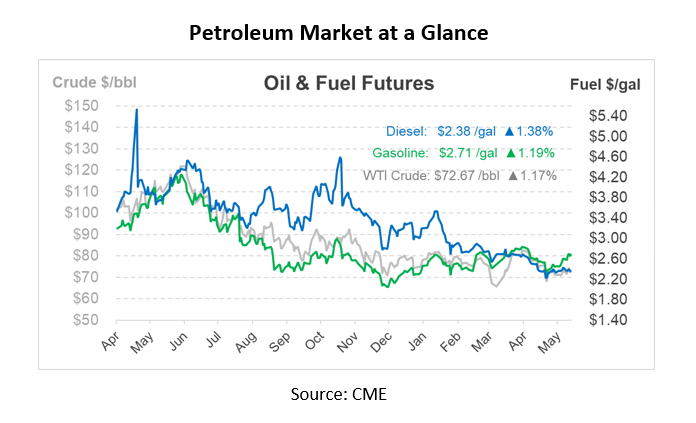

Mid-week brought a slight incline in crude prices, reaching a near three-week peak. This development came after Russian Deputy Prime Minister Novak dismissed the probability of further OPEC+ production cuts, thereby contradicting the earlier cautionary note from the Saudi Energy Minister to speculators. Despite this, Prompt WTI and Brent prices experienced a decline of over $2/bbl from their weekly highs of $74.73/bbl and $78.66/bbl, respectively, yet they remain on track to achieve a second week of consecutive gains.

Oil prices are likely to see a boost should an agreement be reached regarding the increase of the U.S. debt ceiling. Both Republican and Democratic negotiators are inching closer to an agreement that would raise the debt limit and establish a two-year cap on federal spending. Although a detailed agreement remains elusive, it’s clear that the differences between both parties have significantly narrowed. House Speaker McCarthy has expressed his commitment to resolving these remaining discrepancies over the forthcoming holiday weekend.

However, fears surrounding sluggish global demand growth have capped gains, especially in the face of the anticipated rise in oil demand during the second half of the year, predominantly from China. The dollar has witnessed a surge this month against a collection of major currencies, which indirectly affects the oil industry as it makes dollar-based commodities, including oil, more costly for holders of other currencies.

The US government is slated to conduct a sale of oil and gas drilling rights on federal lands in New Mexico and Kansas. The auction will cover more than 10,000 acres, with a major portion focused in Cheyenne County, KS. This marks the first such auction since the passage of the Inflation Reduction Act (IRA) last year. As we look ahead, these auctions and potential political agreements promise a dynamic period for oil markets in the coming weeks.

Prices in Review

Crude opened the week at $71.70 and saw incremental increases through Thursday. This morning, crude opened at $71.89, almost in line with Monday’s numbers. This accounted for a marginal increase of 19 cents or 0.265%.

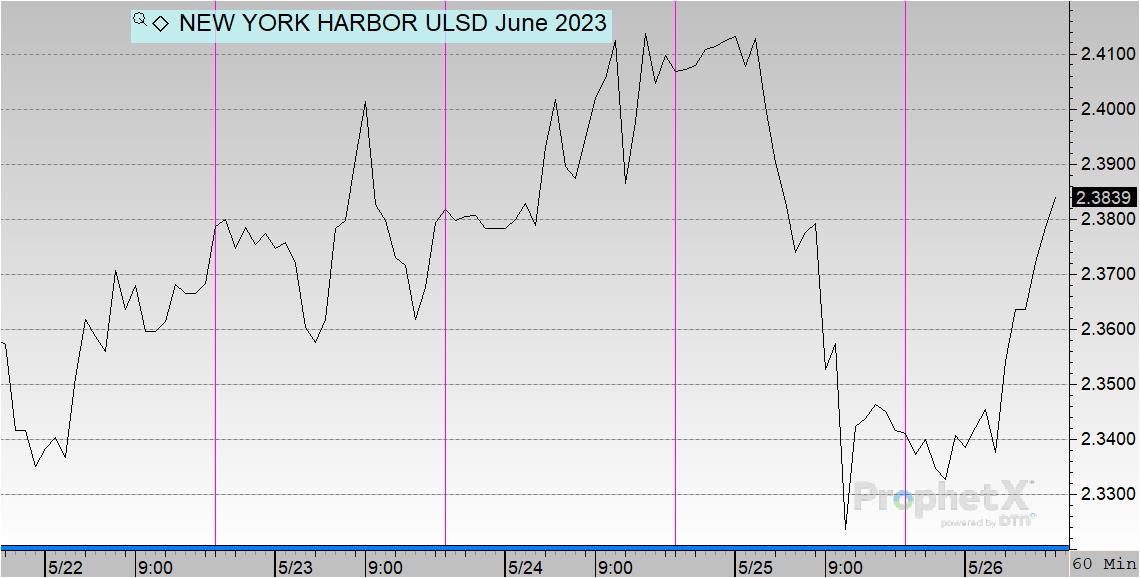

Diesel opened the week at $2.3669 and also saw small increases throughout the week before dropping off Thursday. This morning, diesel opened at $2.3413, a decline of just over two cents or -1.082%.

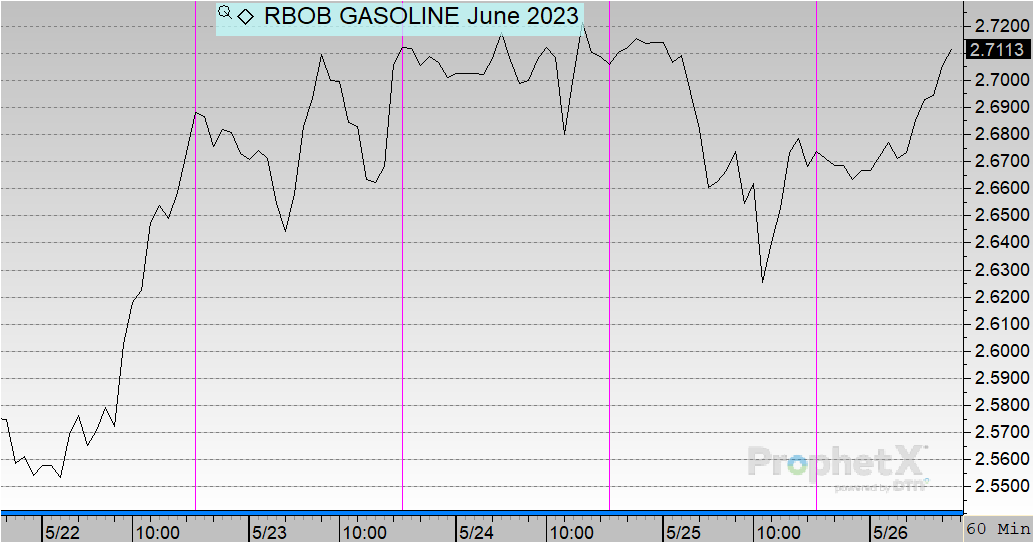

Gasoline opened on Monday at $2.5779 before reaching its highest price of $2.71 on Thursday. This morning, gasoline opened at $2.6712, accounting for an increase of nearly 10 cents or 3.62%.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.