EIA Lowers Crude Oil Price Forecast for Second Half of 2023 and 2024

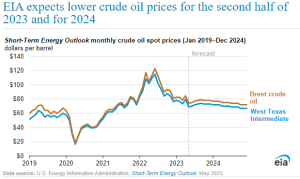

In the U.S. Energy Information Administration’s (EIA) most recent Short-Term Energy Outlook (STEO), they included some updates on crude oil prices. According to the EIA, they have revised their forecast for the rest of 2023 and 2024 and lowered their predictions for crude oil prices, citing a notable decline in prices that has been ongoing since April.

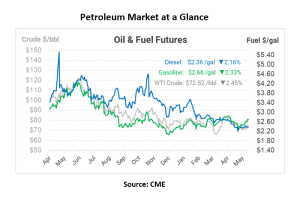

Between April 12, 2023, and May 4, 2023, the price of Brent crude oil plummeted by $16 per barrel, reaching $73 per barrel. The West Texas Intermediate crude oil price dropped $15/b to $69/b. These drops led the EIA to expect only moderate price increases in the coming months. They believe this will be driven by a decrease in OPEC production and an increase in demand.

Why have crude oil prices been on the decline lately?

A combination of supply and demand factors may have contributed to this outcome. On the demand side, there have been concerns about China’s economic growth. News of a decrease in China’s manufacturing Purchasing Managers’ Index, which tells us about economic conditions, has raised some concerns. Adding to that worries about a potential U.S. recession have been fueled by the banking sector, especially after the closure and subsequent sale of First Republic Bank.

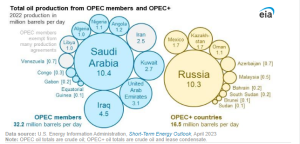

On the supply side, Russia has been pumping out more oil than expected. This has increased the global oil supply and put downward pressure on crude oil prices. However, in April 2023, OPEC+ members decided to cut oil production for the rest of the year. According to the EIA’s May forecast, OPEC’s total production of liquid fuels is predicted to decrease from 34.0 million barrels per day (b/d) in April to an average of 33.7 million b/d for the remaining months of 2023.

Source: EIA

Additionally, recent disruptions in crude oil exports from Iraq and a force majeure event that has limited crude oil exports from Nigeria have also impacted the EIA’s near-term forecast for OPEC’s liquid fuels production. These supply constraints are expected to push crude oil prices higher. Looking ahead to 2024, the EIA anticipates that OPEC’s liquid fuels production will bounce back and increase by 0.7 million b/d to 34.4 million b/d as the current OPEC+ production cuts come to an end in 2023.

According to the EIA’s projections, the price of Brent crude oil is expected to rise from $74/b in May 2023 to $79/b in September before experiencing a slight decline to an average of $78/b in the last three months of 2023. The West Texas Intermediate price is expected to follow a similar path.

While these revised forecasts from the EIA provide us with insights into the expected trajectory of crude oil prices for the second half of 2023 and 2024, it’s important to keep in mind that unforeseen events, changes in the global economy, or other market developments could still have an impact on these predictions.

Fuel Price Risk Management

Why take on unnecessary risk when you can ensure cost stability, achieve budget objectives, and enjoy peace of mind with fuel price risk management?

Mansfield Energy provides essential tools to assist you in preparing for unforeseen circumstances and reducing the effects of unpredictable events — such as extreme weather, geopolitical incidents, pipeline disruptions, refinery closures, and market fluctuations — on your fuel budget. When it comes to managing the risk associated with fuel prices, there is no universal solution. Mansfield offers a variety of customized options tailored to your specific requirements, including Fixed Price, Price Cap, and Collar strategies.

Get in touch today to discover more about our price risk management program.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.