Andy’s Answers: Quick-Hit Insights from Supply SVP Andy Milton

Analysis by Andy Milton

Today’s article is a round-up of insights shared by Andy Milton, Mansfield’s Senior Vice President of Supply. Learn what’s driving the market up and down from an industry expert with decades of experience.

On Refining Margins: While refinery cracks have come down, they are still over $30/bbl which is incredibly high historically speaking. [Click Here for a recap on Crack Spreads]

On local fuel prices: We have pockets in the U.S. of crazy basis values. Basis is the difference between the NYMEX fuel price (which we publish daily in FUELSNews) and regional fuel prices. High basis values mean that customers in a regional market are paying more than the NYMEX price.

- California gasoline (physical) is trading $2.50 OVER the RB futures. Normally this is a .25-.50 cent market.

- Chicago gasoline (physical) is trading $1.00 over the RB futures.

- West Coast diesel is trading $.50 over the ULSD futures – normally maybe a .10 cent market

- These situations are due to unplanned refinery hiccups. Luckily, we are out of driving season.

- Gulf Coast ULSD basis jumped yesterday from flat with the NYMEX to roughly +$.12. It’s starting out today at +$.08 for the new cycle. For context, the balance of month is trading negative to the NYMEX.

On East Coast Supplies: The “up/down” on the East Coast (the difference between Gulf Coast prices and New York Harbor) is also something to watch right now. It’s widened out as well the last few days. If that continues, it could leave the East Coast tight(er) on supply. We are monitoring.

On Inventories: DOE’s this Wednesday should be watched closely. Over the last 4 weeks diesel fuel days of supply has moved from 29 to 34 and last week back to 32.

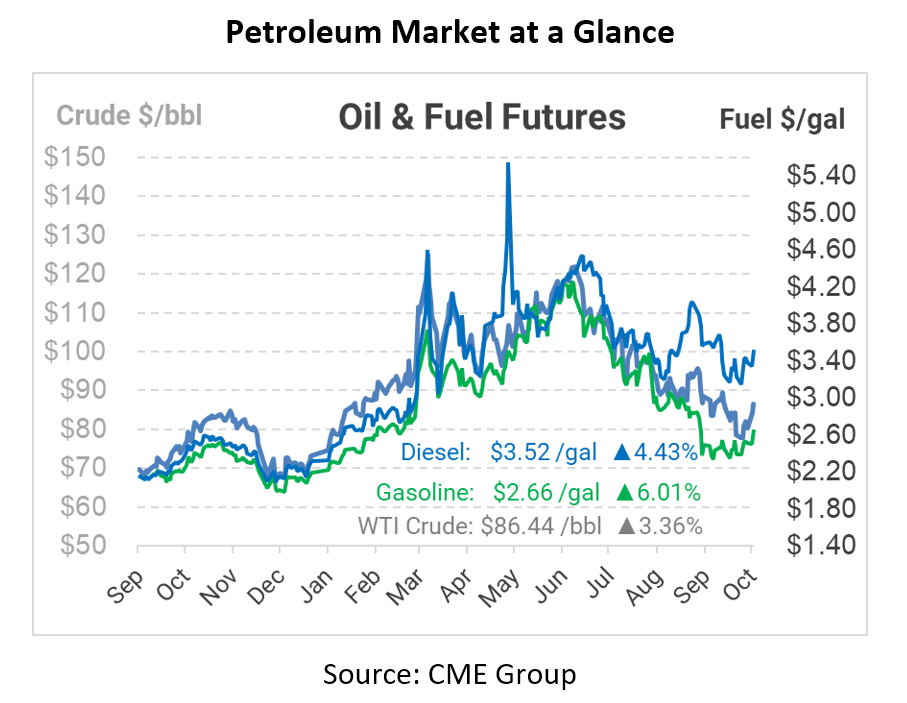

On Futures Prices: Backwardation has widened the last few days. We are now at 20 cents from front month ULSD futures to the 3rd month. [Click Here for a recap on Futures Markets.] It “feels” like something has triggered here but we’ll need more price action to confirm. Again, days of supply is worth monitoring on Wednesday’s DOE’s.

On the Dollar: Note the US dollar has been a bit weaker the last few days, possibly helping the higher commodity values.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.