What Is It: Backwardation & Contango

Once you understand the basics of the NYMEX futures market, it’s simple to see that traders aren’t trading one single “WTI crude oil” contract. In reality, they’re trading dozens of future dated months at the same time, with most of the volume concentrated in the soonest “prompt” month. When you put all of these future months together, you get what’s called a forward curve. The direction of that curve – either up or down – has very important implications for fuel supply dynamics. Today, we’ll talk about backwardation and contango, the two ways that future markets can be structured.

Defining the Terms

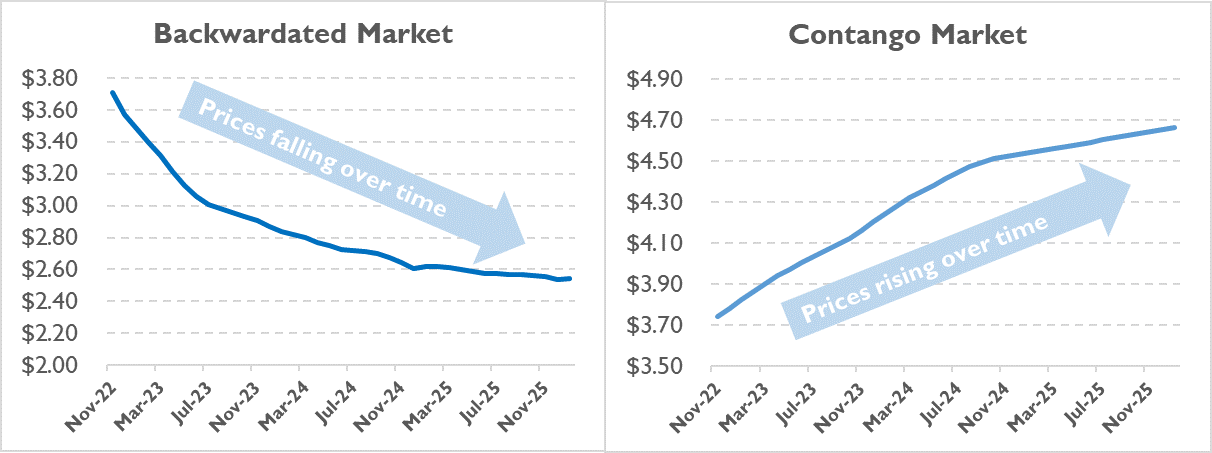

When future prices are higher than current prices, and the forward curve is sloping upward, it’s called “contango”. The reverse, when future prices are lower and the curve slopes downward, is called “backwardation.”

The forward curve is a form of forecasting. Traders either think future prices will be higher or lower than current prices. Depending on the direction, you end up with one of the above structures. Of course, those traders aren’t necessarily “right” – the curve is moving up and down all the time based on trading activity.

For context, all of the following have been real market prices for diesel delivered in November 2022. During the 2020 pandemic, traders thought the bear market would never end. In June 2022, traders expected the price to remain stubbornly high. When the November contract settles at the end of October, we’ll find out who was right – but clearly, the market can be very wrong, even just a few months out.

What Causes Backwardation & Contango?

Ultimately the direction of the forward curve is most impacted by supply and demand. In general, markets become contango when supply is tight right now, requiring higher prices now to encourage more production and inventory withdrawals. On the flip side, when there’s too much supply, markets flip to contango as near-term prices fall. Market sentiment can also play a role: if the market thinks demand is strong now but expects very weak demand in the future (say, due to a recession), it may bid down future prices and put the market into backwardation.

What Do These Mean for Supply and Prices?

The direction of the market is very important for physical fuel suppliers. When markets are in backwardation (future prices are lower than today), suppliers are incentivized to pull fuel from storage and put it on the market now, before prices fall. Conversely, contango means higher prices in the future, so suppliers have more reason to put fuel into storage and sell it later. This effect can create a feedback loop: backwardation, which occurs because supplies are already tight, causes inventories to fall, which in turn leads to even higher prices and supply concerns. In this way, although backwardation technically means the market expects lower prices in the future, it typically comes at a time when prices are rising.

Another reason why backwardation is bullish is because of trading fundamentals. If a trader owns NYMEX contracts equivalent to 1 million gallons of diesel fuel valued at $2.00/gal, they have $2 MM in contracts. When the current month’s contract expires, it rolls to the following month. Let’s say that month only costs $1.97 (due to backwardation), so their $2 MM can buy 1.015 million gallons. Thus, backwardation allows them to increase the size of their holdings over time without putting up more cash – a great deal for the trader. For this reason, commodities traders flock to backwardated markets, pushing up the price even when the underlying fundamentals haven’t changed.

How Can I Use This to My Advantage?

While the forward curve is constantly moving and adjusting, there is one benefit – it allows fuel buyers to lock in a fixed price for a prolonged period using futures prices. When the market is backwardated (which, as we saw, often comes when prices are moving upward), fleets can lock in a future price much lower than current prices. While this isn’t a way to “beat” the market, it is a way to immediately lower your fuel price towards the average of the forward curve. Learn more by contacting a Risk Management expert.

This article is part of Daily Market News & Insights

Tagged: Backwardation, Contango, forward curve, NYMEX

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.