Natural Gas News – January 18, 2022

Natural Gas News – January 18, 2022

Arctic Cold Snap Could Push U.S. Natural Gas Prices Higher

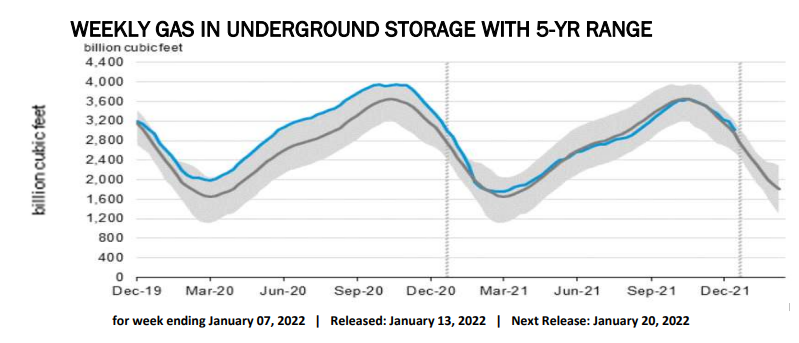

Forecasts of frigid temperatures later this month sent U.S. natural gas prices surging in the middle of last week to above $4.85 per million British thermal units (MMBtu)—the highest level since November. If the cold snap expected over the next two weeks holds and forecasts for additional Arctic blasts this winter materialize, natural gas at the Henry Hub could surge to above $6/MMBtu again, in a pattern similar to the one from the winter of 2014, when the polar vortex drove demand high and pushed up prices, analysts say. U.S. natural gas prices were on a rollercoaster ride last week, surging by 14 percent on Wednesday to a six-week high, due to cold weather, before retreating by 12 percent on the following day “on the prospect for weather turning milder and after the weekly stock draw was in line with expectation… For more info go to https://bit.ly/3GHo043

3 Key Trends Driving Natural Gas In 2022

The oil sector has been hogging the investment limelight after a spectacular recovery that has set the sector as one of the top performers in 2021. However, it’s natural gas bulls who have been having a real ball with natural gas trading at their highest levels since 2014, outpacing oil and many other commodities. The natural gas sector is off to another good start, with natural gas prices (Henry Hub)

up 20% to $4.19/MMBtu since the beginning of the year, thanks to robust demand. Natural gas prices have popped nearly 10% over the

past few days after updated weather forecasts called for freezing temps in the northeast for the duration of January. The forecast comes on the back of winter storms hitting the east coast over the weekend, driving Algonquin city-gate nat gas prices as high as $24/MMBtu. Many New England … For more info go to https://bit.ly/33ofkkX

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.