Natural Gas News – October 5, 2021

Natural Gas News – October 5, 2021

Henry Hub gas futures prices flirt with $6 level amid sustained supply crunch

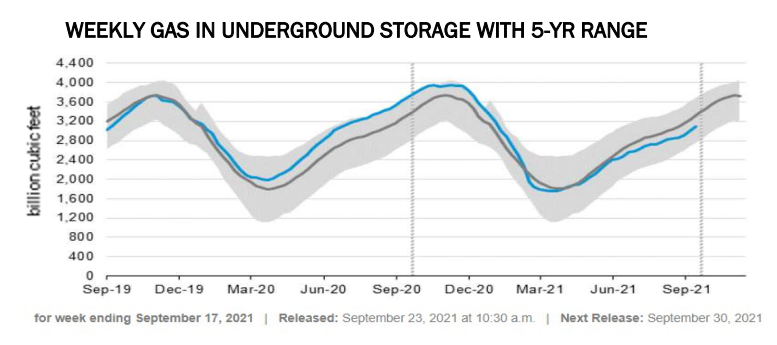

NYMEX Henry Hub prompt-month futures surged briefly to over $6 in Oct. 4 trading as US gas production stumbles below 90 Bcf/d with storage inventories still trailing typical pre-winter levels. The November contract ended trading at $5.77/MMBtu, up about 15 cents on the day, and just 10 cents shy of a recent seven-year high settlement for the prompt-month contract. Gains on the December, January and February contracts were of only slightly smaller magnitude with the peak-winter months all settling in the $5.80 to $5.90 range, data from S&P Global Platts showed. The precipitous surge in NYMEX futures accompanied gains in the cash market where prices were up about 30 cents Oct. 4 to trade in the upper $5.80s/MMBtu, preliminary settlement data showed. Over the near term, weather forecasts calling for unusually mild…

Energy Prices Spike as Producers Worry Over Pandemic and Climate

Even as more costly fuel poses political risks for President Biden, oil companies and OPEC are not eager to produce more because they worry prices will drop. HOUSTON — Americans are spending a dollar more for a gallon of gasoline than they were a year ago. Natural gas prices have shot up more than 150 percent over the same time, threatening to raise prices of food, chemicals, plastic goods and heat this winter. The energy system is suddenly in crisis around the world as the cost of oil, natural gas and coal has climbed rapidly in recent months. In China, Britain and elsewhere, fuel shortages and panic buying have led to blackouts and long lines at filling stations. The situation in the United States is not quite as dire, but oil and gasoline prices are high enough that President Biden has been calling on foreign…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.