PPL Main Lines Shut Down – OPEC+ Meet Today

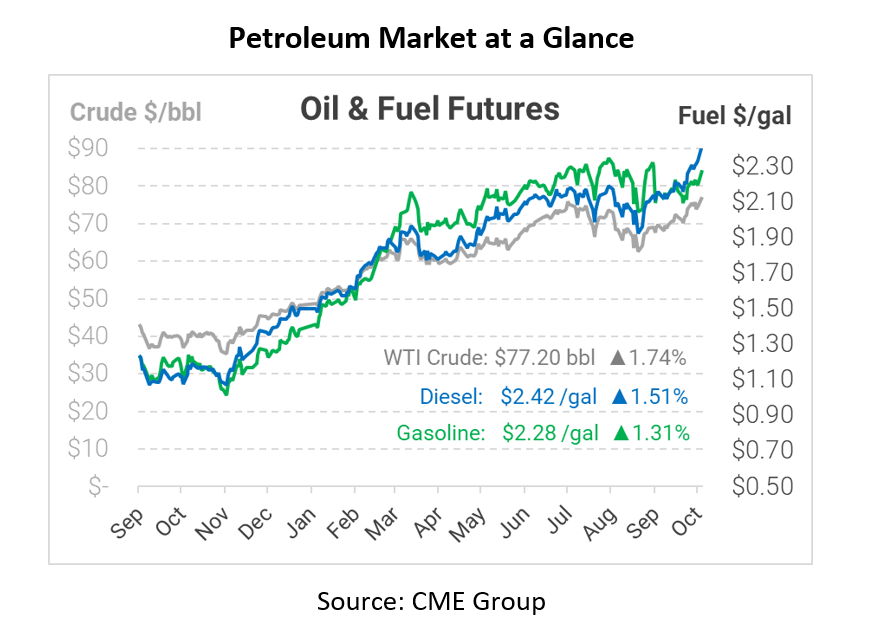

This morning crude opened at $75.90, hitting a high of $77.26 so far. With diesel and gasoline opening at high prices of $2.3826 and $2.2450, respectively, there seems to be a trend of rising prices ahead of the much-anticipated OPEC+ meeting later today. Also making headlines, a southeastern fuel pipeline has been shut down after officials discovered what appeared to be fuel-contaminated water in Alabama.

This weekend, Products (SE) Pipe Line Corporation (PPL) confirmed that a petroleum sheen was reported at Buck Creek in Alabama. This leak appears to have originated from a nearby pipeline segment. While parts of the pipeline remain down, active cleanup is underway, with the site having already been secured. PPL continues to repair the affected pipeline segments and will have restart plans initiated once local, state, and federal agencies coordinate. The PPL runs from Texas into the southeastern US along a route similar to the Colonial Pipeline, though delivering lower fuel quantities. While the cause and quantity of the release are still unknown at this time, Mansfield will continue to monitor the situation closely and send updates when they arrive. PPL has also stated that they plan to begin the restart process for non-impacted segments later tonight.

In other oil news, OPEC and its allied members, collectively known as OPEC+, are meeting today to discuss how much oil should be released into the market. So far, with supply disruptions and the ongoing economic recovery efforts worldwide, international oil prices are pushing above $80 per barrel. Back in July, OPEC+ agreed to boost output in the market by around 400,000 barrels per day each month through April 2022. While specific numbers are unknown, some reports suggest that OPEC+ could change the deal to add more output per day. One thing remains certain – rising oil prices globally are slowing recovery efforts and contributing to rising inflation, so OPEC+’s decision will face significant scrutiny regardless of the outcome.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.