Inventories, Interest Rates and Iran

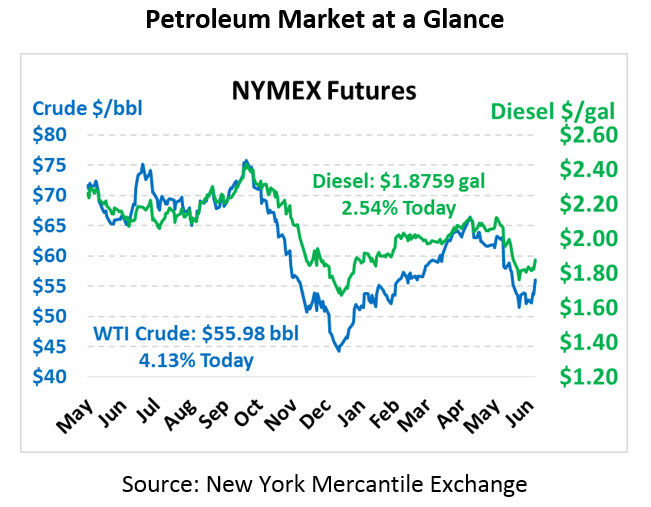

Oil is trading sharply higher as geopolitical unrest continues escalating in the Middle East. Crude oil is trading at $55.98, a quick increase of $2.22 (4.1%).

Fuel prices are following crude higher. Diesel is trading at $1.9759, up 4.7 cents (2.5%) from yesterday’s close. Gasoline is $1.7694, up 3.4 cents (2.0%)

Markets are awash with bullish indicators this morning. At the top of the list, Iran shot down a US drone over the Strait of Hormuz this morning, claiming it was in fact over Iranian territory. Until now, most of the conflict between the US and Iran has been indirect, fought on economic grounds or through unclaimed attacks on US allies. Regardless of whether the drone was actually over Iranian territory, it raises concerns of a potential miscalculation on either side leading to open conflict between the US and Iran. If the past is any guide, expect a Twitter storm today and tomorrow between Trump and Iranian officials as more information is released.

Adding to oil’s rally is the Fed’s decision to hold interest rates steady, with a bias to lowering rates either later this year or next. In fact, eight of the seventeen Fed chair members are expecting rates to be lowered this year. Declining interest rates weaken the US dollar, which is negatively correlated with commodities (ie, weak dollar boosts commodity prices). Even as the economy turns weaker, a falling dollar can help boost financial markets such as oil.

Last, and more native to oil markets, oil stocks fell strongly according to the EIA’s report. Across the board, oil product inventories turned lower for the week. The steep draw in inventories came as both imports and domestic production were slightly lower for the week, while exports rose. The large drop is a decisive break from the recent string of inventory builds, and perhaps may herald the late arrival of crude’s summer de-stocking pattern.

US gasoline demand reached an all-time record high last week, surpassing 9.9 MMbpd for the first time since the EIA began publishing data in 1991. While weekly data can be somewhat noisy, the 4-week average shows demand up roughly 1.7% from this time last year. As we move farther into summer gasoline season, expect demand to remain strong for the next several weeks.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.