Week in Review

For the week, the Crude Market was up. It started out Monday down on generally little news but with the overall global economic slump weighing on the market. Tuesday saw an uptick on the news of renewed hope for a trade deal with China, with a meeting scheduled during the G-20 Summit.

By mid-week we saw three bullish factors take the market higher. Inventories saw a draw in stock which helped to lift prices. In addition, the Fed seemed to signal a more accommodative interest rate policy which would bring about a weaker dollar and a weaker dollar is generally bullish for oil. Finally, building tensions in the Middle East following Iran shooting down an unmanned drone helped to pull the market higher.

Prices in Review

WTI Crude opened the week at $52.50. Iran’s announcement of war readiness and general tensions in the Middle East continue to pull the market higher on Friday. The market opened on Friday at $57.26, a gain of $4.76 (9.1%).

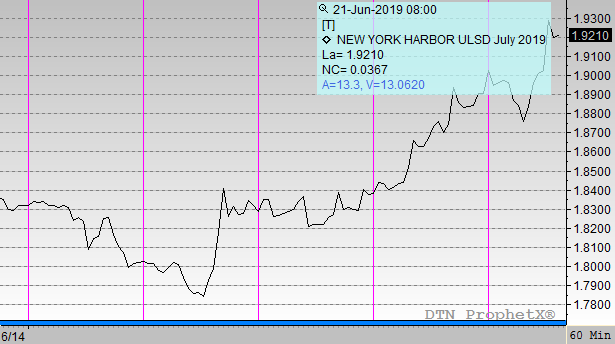

Diesel opened the week at $1.8282. It followed crude higher throughout the week. Diesel opened Friday at $1.8942, a gain of 6.6 cents (3.6%).

Gasoline opened the week at $1.7377. It also followed crude higher throughout the week. Gasoline opened Friday at 1.7887, a gain of 5.1 cents (2.9%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.