Rack-to-Retail Spreads Swell

After crude prices picked up $2/bbl yesterday, markets are cooling off and awaiting EIA data later this morning. Crude oil this morning is currently trading at $53.57, down 33 cents.

Fuel prices are also taking a breather after both products saw roughly 3 cent gains. Diesel is trading this morning at $1.8224, down half a cent from Tuesday’s closing price. Gasoline is currently $1.7079, down 1.4 cents.

The API released their weekly report yesterday afternoon, and markets are generally focused on the slightly smaller than expected crude draw. Although small, the draw helps disrupt the overall up trend crude inventories have shown; in the past eleven weeks, nine weeks have seen crude builds. On the fuel side, the API forecasts higher gasoline stocks and lower diesel stocks.

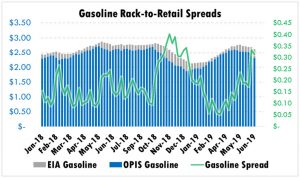

Rack-to-Retail Spreads

While fuel prices have trended sharply lower over the past couple months, retail fuel buyers have not enjoyed the full benefits. Rack-to-retail spreads, the difference between the average bulk fuel price and what you’d pay at a truck stop or gas station, have increased rapidly over the past few weeks as bulk prices have dropped.

Back in October 2018, spreads blew out to extremely high levels as fuel prices plummeted. Prices are revisiting those highs now, with gas station prices roughly 30 cents over bulk fuel prices, while retail station is a whopping 60 cents over bulk pricing. Typical spreads are closer to 15 cents and 35 cents for gasoline and diesel, respectively.

What does this mean for consumers? Increased volatility has made its way to rack-to-retail spreads, causing extreme pricing variances. If you’re buying fuel at gas stations today, the case for bulk fuel economics has never been better. Buying on an OPIS Average provides substantially more downside participation when prices fall, since retail prices rarely fall as quickly.

Businesses have two options for attaining bulk economics. Many install a backyard fuel tank to ensure reliable supply and cheaper fuel prices. Depending on your demand, installing a bulk tank could have a relatively quick ROI, within a year or two. For low demand locations, perhaps a mini-bulk tank would be more appropriate.

Some customers prefer to avoid tank installations due to capital costs and regulatory concerns. For these buyers, mobile fueling is an ideal alternative that still provides OPIS-based pricing. Mobile fueling comes with added labor savings, allowing your drivers to spend less time fueling and more time generating revenue.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.