Natural Gas News – February 25, 2019

Natural Gas News – February 25, 2019

1-Fight Against Pollution to Lift LNG Demand -Shell

CNBC reported: Global liquefied natural gas (LNG) trade is set to rise 11 percent this year as China leads a global drive to reduce pollution and tackle carbon emissions, Royal Dutch Shell said in an annual LNG report on Monday. Shell’s forecasts, which see LNG demand rising to 354 million tonnes this year and to 384 million tonnes in 2020, reflect a burgeoning industry with new production facilities opening in Australia, the United States and Russia and more countries becoming importers by constructing receiving terminals. Shell, the world’s largest buyer and seller of LNG as well as a major producer, said that China is set to double its LNG consumption by 2035 after it accounted for over half of the growth in traded volumes last year.

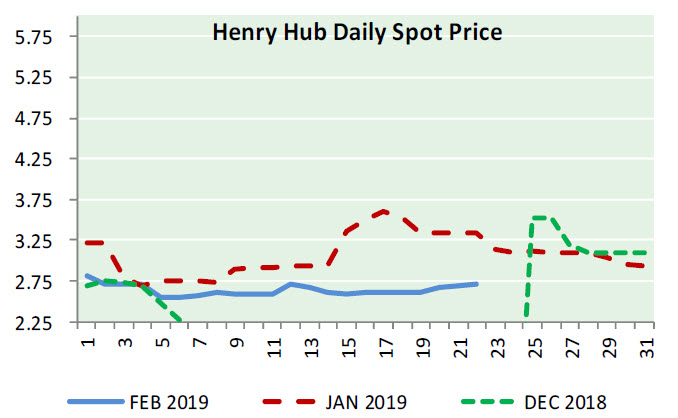

U.S. Natural Gas Prices Now Range Bound

Forbes reported: After some boring times in Summer and Fall, it has been a wild and crazy ride for natural gas prices this Winter 2018-2019. We have seen the most volatile U.S. gas market since 2009. Prices hit highs not seen since 2014 and lows not seen since 2016. Since November, prompt month gas prices have been in the very wide range of $2.55 to $4.85 per MMBtu. It was a cold and early start to winter in November, augmented by the fear of storage levels nearly 20% below the five-year average, that got the party started. Yet, here we are in February, usually the third coldest month, and natural gas prices have simmered down quite a bit. Over the past three weeks, gas prices have varied by only 18 cents, compared to 78 cents the three weeks prior. Demand thus far in February has been averaging around 110 Bcf/d, down slightly from 114 Bcf/d in January but up from 100 Bcf/d in December. Overall, year-over-year, new production has been 9 Bcf/d, or above the 6 Bcf/d of new demand, making today’s market 3 Bcf/d oversupplied.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.