Shuttering Markets in 160 Characters or Less

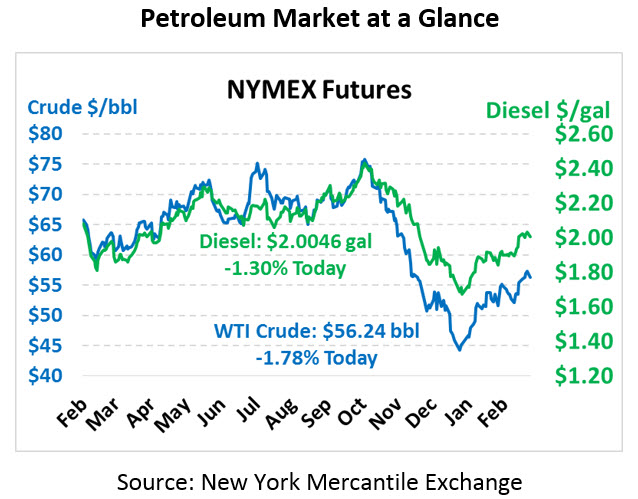

Imagine if you could alter the course of oil prices with just a few words…actually, 19 words, to be precise. Well, if your name is Donald J. Trump, then you’re just imaging this morning. With a single Tweet, Trump sent oil prices spiraling almost $2/bbl this morning after markets neared 2019 highs. After bottoming out at $55.70, prices have bounced a bit higher. This morning, crude oil is currently trading at $56.24, down $1.02 (1.8%) from Friday’s close.

Fuel prices are down just as sharply. Diesel prices are trading at just $2.0046, down 2.7 cents (1.3%) after Friday’s high close. Gasoline prices are $1.5774, dropping below the $1.60 threshold after losing 3.4 cents (2.1%).

Oil prices had been on the up-mend this morning before the tweet. Trump on Sunday said the US will delay tariff increases on China, which were originally scheduled to take hold on Saturday. Trump’s message revealed “substantial progress” on a number of key issues, setting the stage for a possible meeting between Trump and Chinese President Xi later this month. Markets still do not know whether the deal will include reductions in existing tariffs, or if it merely avoids steeper tariffs.

Shuttering Markets in 160 Characters or Less

What Tweet could possibly cause that fast of a reaction in oil prices? Surely Trump must have declared war on someone, or perhaps announced a (new) national emergency? Nope. Trump simply tweeted that oil prices are rising too high and that OPEC needs to “relax.” Congress has been evaluating a “NOPEC” (No Oil Producing & Export Cartels) bill as recently as this month, which would allow the US to sue OPEC and other producing countries under the Sherman Antitrust Act. Both Bush and Obama shot down similar legislation during their terms, but Trump seems more open to signing an anti-OPEC bill.

Of course, just because our courts can prosecute foreign countries doesn’t make those rulings meaningful. No American can force Saudi Arabian leaders to visit our courts. The lawsuits would be largely symbolic, though they would create a diplomatic headache for their foreign leaders (and American diplomats seeking cooperation on other initiatives). Passing NOPEC legislation would create a ripple effect through international diplomacy, opening the pathways for other countries to take the US to court over climate change and other issues.

In past years, Congress was willing to be hawkish with OPEC because they knew the President would veto such bills. It’s yet to be seen whether Congress has the appetite to pass the bill this time, knowing that a NOPEC bill would likely be signed into law by President Trump.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.