Natural Gas News – March 7, 2024

Natural Gas News – March 7, 2024

Natural Gas News: Production Cuts Offer

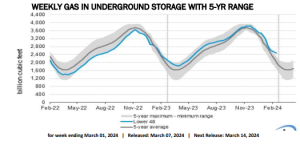

U.S. natural gas futures are experiencing a modest rise as they consolidate for a second day. The market’s focus is on the impending U.S. Energy Information Administration (EIA) weekly storage report. Anticipation is high for today’s EIA report, especially following last week’s bullish outcome. A notable reduction in U.S. production is suggested by the previous week’s larger-than-expected draw. Survey averages predict a draw of -40 billion cubic feet (Bcf), significantly lower than the 5-year average of -93 Bcf. This discrepancy is attributed to warmer temperatures across most of the U.S. and robust wind energy production. Our estimate stands at a draw of -34

Bcf, potentially leading to a surplus increase to +550 Bcf. From March 7-13, weather systems will affect the Western U.S. with varied conditions. The Midwest… For more info go to https://tinyurl.com/4zk94hwy

Nat-Gas Prices Slip

April Nymex natural gas (NGJ24) on Wednesday closed -0.028 (-1.43%). Nat-gas prices on Wednesday closed moderately lower. The outlook for warmer U.S. weather that will reduce heating demand for nat-gas weighed on prices after Maxar Technologies on Wednesday said that forecasts have trended warmer in the central, southern,

and eastern parts of the U.S. from March 11-15. Short-covering on Tuesday pushed nat-gas prices to a 1-month high on carryover support from Monday when EQT Corp, the largest U.S. nat-gas producer, said it would cut about 30 to 40 billion cubic feet of net production through March in response to low prices. Nat-gas prices have collapsed this year and plunged to a 3-1/2 year nearest-futures low (H24) last week as an unusually mild winter curbed heating consumption for nat-… For more info go to

https://tinyurl.com/ynd6bhae

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.