Week in Review – March 8, 2024

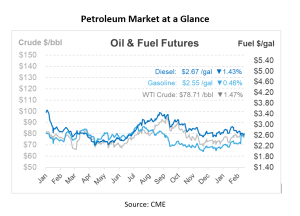

Consumers are seeing a glimmer of hope as oil prices decline, influenced by potential interest rate cuts in the US and Europe. This sentiment is balanced against the anticipation of substantial global supply throughout the year. Prompt crude futures fell by over 20 c/bbl this morning, erasing earlier gains that nearly reached $80/bbl. This shift reflects broader market uncertainties, particularly ahead of the anticipated US nonfarm payroll report, further influenced by lower equity futures.

In market movements, the WTI and Brent oil benchmarks saw adjustments in their pricing, with WTI prompt prices set to conclude the week down by over $1.50/bbl. After an initial drop earlier in the week, the diesel market rallied in the subsequent days, showcasing the volatility and the competitive forces at play in fuel pricing.

Platts reported this week that OPEC+ crude output in February remained steady at 41.21 Mbpd, indicating a high compliance rate with announced production curtailments. Despite this, Iraq and Kazakhstan’s production levels exceeded their quotas, contributing to the supply landscape. Russia’s crude output also increased, further contributing to the global supply.

In terms of U.S. oil and fuel inventories, crude oil stocks are currently around 1% below the five-year average for this period. Gasoline reserves are 2% under the five-year norm. At the same time, distillate stocks – which include diesel and heating oil – are significantly lower, standing 10% beneath the five-year average for this time of year.

Since the beginning of the year, U.S. refinery utilization has dropped by 11%, reaching lows of 81% in the weeks ending on February 9th and February 16th. Despite U.S. retail gasoline and diesel prices being lower than at this point in 2023, a decline in regional inventories last month has led to increased retail prices for both fuels over the recent month. This significant decrease in refinery utilization can be attributed to scaled-back operations across the Midwest and Gulf Coast regions.

The Keystone oil pipeline, a dominant infrastructure for Canadian crude transport into the US, resumed operations yesterday after a temporary shutdown due to operational concerns. The Keystone pipeline disruption occurred while shippers were anticipating the completion of the Trans Mountain pipeline expansion. This project will significantly increase the pipeline’s capacity to transport oil from Alberta to the British Columbia coast, nearly tripling it and offering a much-needed solution to the congestion in Canada’s pipeline infrastructure.

Prices In Review

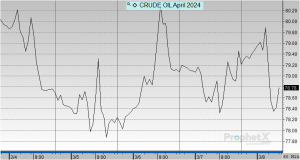

Crude futures started the week at $80.14/bbl, decreased in both sessions on Tuesday and Wednesday before experiencing a slight increase on Thursday. This morning, crude opened at $79.51, a decrease of 63 cents or -0.786%.

Diesel futures opened the week at $2.7129 and saw marginal dips in Tuesday and Wednesday’s sessions before a slight increase on Thursday. This morning, diesel opened at $2.6981, a decrease of nearly 2 cents or -0.545%.

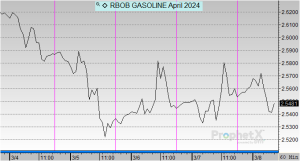

This morning, gasoline opened at $2.5638, a decrease of 5 cents or -1.94%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.