US Oil Pipeline Volumes Reach New Highs in Q4

The US saw its crude oil pipeline flows reach a new high in the fourth quarter, with volumes hitting 16.5 million barrels daily (b/d). This surge, led by increased production in the Permian basin, marks a significant recovery in the sector.

Data from four major US midstream operators show a 6% increase in crude pipeline volumes from the last quarter, surpassing the previous low of 10.8 million b/d in the first quarter of 2021. This period was the lowest point during the COVID-19 pandemic. The current figures exceed the pre-pandemic levels of 14.3 million b/d in early 2020.

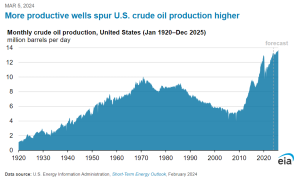

The growth is mainly attributed to the Permian basin, which spans west Texas and eastern New Mexico. According to The U.S. Energy Information Administration (EIA), the US crude production reached a record 13.3 million b/d in December.

Plains, a key player in the midstream sector, projects Permian output to scale new heights in 2024, aligning with oil majors’ strategies to amplify production in this leading shale basin. With an anticipated increase to 6.4 million b/d from 2023’s 6.1 million b/d, the focus remains on enhancing efficiency, even as the rig count maintains a steady pace. Industry leaders express confidence in the innovative ability of US exploration and production companies to unlock higher recoveries from the Permian’s vast resources.

Infrastructure and Investment

Investments in infrastructure and technological advancements are crucial to this growth trajectory. Chevron and ExxonMobil focus on longer initiatives to extend well lengths and expedite drilling processes, aiming for significant output expansions from the Permian. Plains reports a 17% quarter-on-quarter increase in long-haul volumes on its crude pipelines, with heightened utilization expected on its major conduits, like the Cactus II pipeline, in partnership with Enbridge.

Broader Impacts and Outlook

This record-setting performance extends beyond the Permian, with significant operators experiencing substantial volume increases across their networks. This expansion is driven not just by organic growth but also strategic acquisitions, enhancing connectivity and storage capabilities crucial for sustaining the momentum.

As the US midstream sector rides this high tide, the implications for global energy markets, pricing dynamics, and the geopolitical landscape are profound. In summary, the record-high crude pipeline flows in the US underscore a period of remarkable growth and resilience for the oil sector, with the Permian basin at the forefront of this movement. You can learn more about the Midstream sector here.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.