Natural Gas News – February 29, 2024

Natural Gas News – February 29, 2024

Natural Gas News: Futures Stabilize with European Demand Surge

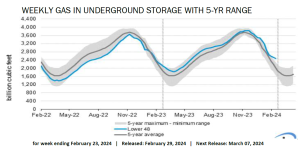

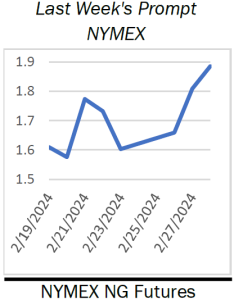

U.S. natural gas futures are exhibiting stability on Wednesday after a notable increase in the previous session. This steadiness is due to growing interest in the European gas market, especially from Asian countries, as recent price drops to multi-year lows have attracted a broader range of traders. At 12:50 GMT, natural gas futures are trading $1.827, up $0.019 or +1.05%. In the United States, natural gas futures have bounced back after falling to their lowest levels in nearly four years. This recovery is primarily due to surplus inventories and high production levels, despite the mild weather conditions which have led to reduced demand. Robert DiDona of Energy Ventures Analysis pointed out that the unexpectedly warm weather from November through March contributed to lower than expected demand and higher storage … For more information, go to http://tinyurl.com/bdfnta6j

This Could Be A Gamechanger For Natural Gas In Europe

Supergiants like Exxon are focused on big offshore venues like Guyana and Namibia, leaving behind prime onshore natural gas assets in Europe – a region that is now desperate for affordable domestic resources that aren’t controlled by Russian Gazprom. Prior to Russia’s invasion of Ukraine, Gazprom was calling the energy shots in Germany. Those days are over. But Germany, the European Union’s biggest economy, still needs natural gas, even if this winter’s storage is nearly full. It’s not full as a result of domestic sources. Germany has traded one form of dependence for another. The filling up of winter storage has come at a high price tag thanks to expensive LNG imports, which are now at risk, as well, due to the Biden administration’s pause on new LNG export projects. At the height of the… For more information. go to http://tinyurl.com/2xv5bae5

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.