Week in Review – March 1, 2024

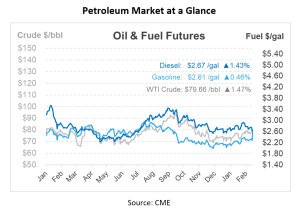

Crude oil futures continued their upward trajectory and opened $1.40/bbl higher this morning. They are poised to conclude the week with a gain of over $3/bbl. Refined product futures and cash prices also witnessed upward momentum during yesterday’s session. This trend highlights a robust demand for gasoline and distillate fuel, potentially hinting at an uptick in crude oil purchasing. Traditionally, the month of March emerges as a time for fuel price increases ahead of the summer driving season and continued scheduled refinery maintenance, tightening supply. Markets are also anticipating disclosure from OPEC on its position to continue production cuts in the second quarter of the year.

The NYMEX March ULSD contract saw a $2.55 increase on Thursday, settling at $2.6838 per gallon, with its April counterpart also climbing by $2.39 to $2.6499 per gallon. Despite a relatively mild winter tempering heating oil demand, distillate production lagging behind last year’s figures has contributed to a steady price plateau. Adding pressure to prices, the U.S. Personal Consumption Expenditures (PCE) index for January revealed inflation figures that aligned with economists’ forecasts on Thursday. This confirmation has strengthened market anticipations of an interest rate reduction in June.

The Energy Information Administration (EIA) reported on Wednesday that U.S. crude oil stockpiles have climbed for the fifth straight week, with an increase of 4.2 million barrels. This rise exceeded expectations, as forecasts had predicted a smaller increase of only 2.7 million barrels. Currently, U.S. crude oil stockpiles stand approximately 1% under the five-year average for this period. Similarly, gasoline reserves are 2% below, and distillate stockpiles are 8% below the five-year norm for this time of year.

Complicating the narrative, the Russian government announced a strategic six-month halt on gasoline exports starting March 1. This move aims to stabilize domestic fuel prices during peak demand periods, such as spring agricultural activities and the holiday season, alongside scheduled refinery maintenance.

Prices In Review

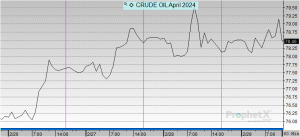

Crude oil started at $76.40 on Monday and trended upwards on Tuesday and Wednesday. There was a slight dip on Thursday, but prices rebounded this morning to $78.28, an increase of 2.46%.

Diesel opened the week at $2.6891, increased on Tuesday before dropping off the remainder of the week. This morning, diesel opened at $2.6523, a decrease of 3 cents or -1.368%.

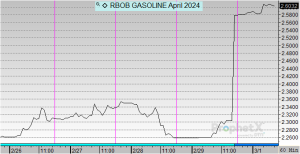

Gasoline opened the week at $2.2752 and saw modest gains on Tuesday and Wednesday before teetering back off on Thursday. This morning, gasoline shot back up to $2.5802, an increase of about 30 cents or 13.41%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.