Natural Gas News – February 13, 2024

Natural Gas News – February 13, 2024

Can A Biden LNG Policy Shift

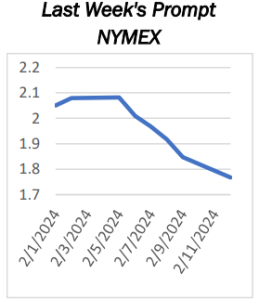

Last week, the natural gas market experienced several key developments that led to a significant drop in prices, reaching a three-year low. This movement in the market was influenced by a mix of factors ranging from increased production to policy changes. During the week-ending February 11, 2024, Natural Gas Futures settled at $1.847, down $0.232 or -11.16%. The most notable factor was the sharp increase in natural gas production, which coincided with a decrease in demand due to unusually mild winter conditions. These milder temperatures significantly reduced the need for heating, thus lowering domestic consumption of natural gas. Further contributing to the surplus was the reduced activity in LNG export plants, leading to an accumulation of supply. The market also reacted to the Biden

administration’s recent… For more info go to http://tinyurl.com/emt8vz6a

Nat-Gas Prices Post 3-1/2 Year Low

March Nymex natural gas (NGH24) on Monday closed -0.079 (-4.28%). Nat-gas prices on Monday extended their month-long decline and posted a 3-1/2 year nearest-futures low. Nat-gas prices are selling off as updated weather forecasts for much of the U.S. are warmer than previously estimated, reducing heating demand for natgas and keeping inventories elevated. Forecaster Maxar Technologies said on Monday that most of the U.S. is expected to

have above-normal temperatures from Feb 22-26, with the central U.S. well above normal. Nat-gas prices are also under pressure after the Freeport LNG nat-gas export terminal in Texas said on January 26 that it shut down one of its three production units for a month for repairs after extreme cold in Texas damaged equipment. The closure

of one of the units… For more info go to http://tinyurl.com/bdewteyh

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.