Oil Prices Fluctuate Amidst Middle East Tensions and Economic Indicators

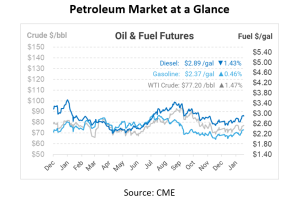

Oil prices have been on a rollercoaster ride in recent days, influenced by a delicate interplay of geopolitical tensions in the Middle East and evolving economic forecasts. Last week, Brent futures surged by 6%, reaching $82.54 a barrel, with U.S. West Texas Intermediate (WTI) crude following suit, trading at $77.42 a barrel. This surge was fueled by ongoing conflicts in Gaza and attacks by Yemen’s Iran-aligned Houthis in the Red Sea, spreading a climate of uncertainty.

The Middle East remains a focal point, with stakeholders closely monitoring developments. Anticipation of diplomatic meetings to seek a truce in Gaza underscores the potential for significant market shifts in response to geopolitical events. Any escalation or de-escalation in the region could trigger price swings of up to $10/barrel, highlighting the sensitivity of oil markets to geopolitical instability.

Moreover, economic indicators, particularly inflation data, are also playing a significant role in oil price movements. Speculation surrounding potential interest rate cuts in the United States has been countered by comments from central bankers, raising concerns about the impact of continued high-interest rates on energy demand. The New York Fed’s January Survey of Consumer Expectations reveals that inflation expectations remain above the Fed’s target rate, underscoring potential challenges for oil demand if rate cuts are delayed.

In addition to geopolitical tensions and economic indicators, OPEC stated that oil demand is expected to rise by 2.25 million barrels per day (bpd) in 2024 and by 1.85 million bpd in 2025, with both forecasts unchanged from the previous month. Experts from the Vienna-based OPEC Secretariat stress the importance of balancing global oil markets amidst varying compliance levels, highlighting the complexities of OPEC’s production decisions and their implications for price stability.

In terms of supply, output from OPEC’s 12 members declined by 350,000 barrels a day in January, as reported by the group. Almost half of this reduction was attributed to a pipeline disruption in Libya, which is exempt from the agreement to voluntarily constrain supplies. While OPEC’s efforts to curtail output have shown some success, challenges remain in achieving uniform compliance across member countries.

Adding to the complexity of market dynamics, the International Energy Agency (IEA) projected demand growth of 1.2 million to 1.3 million barrels a day, according to Executive Director Fatih Birol. This forecast suggests a “comfortable” market with “moderate prices,” providing some reassurance amid market uncertainties.

Meanwhile, the implementation of new cuts within the wider OPEC+ alliance, which includes producers such as Russia and Kazakhstan, remains unclear. Moscow has boosted fuel exports to a six-week high, and only temporarily pared crude shipments when forced to do so by winter storms. The coalition’s current curbs, amounting to approximately 2 million barrels a day, are set to run until the end of the quarter. Saudi Arabia’s energy minister has indicated that they “absolutely” could be prolonged, with delegates aiming to make a decision on the extension in early March.

Amidst these challenges, the transition towards renewable energy sources and climate change mitigation efforts are gaining momentum. Experts from diverse backgrounds, including energy analysts and environmental researchers, emphasize the importance of sustainable energy solutions in shaping long-term oil demand. Saudi Arabia’s recent decision to halt the expansion of oil production capacity underscores this shift toward cleaner energy alternatives, reflecting broader global trends toward sustainability.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.