Natural Gas News – January 16, 2024

Natural Gas News – January 16, 2024

European Natural Gas Prices Slump As Lower Demand

Europe’s benchmark natural gas prices dipped on Monday morning in Amsterdam by 4.8% amid weak industrial demand and bigger-than-average stockpiles for this time of year, despite a prolonged cold snap in northwestern Europe and signs that Qatar may have paused at least five LNG tankers in and around the Red Sea. The front-month February Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, had slid by 4.82% at $33.35 (30.45 euros) per megawatt-hour (MWh) as of 9:47 a.m. in Amsterdam on Monday. The prices have largely ignored the deep freeze of the past week in most of Europe as traders believe the market is well supplied to finish this winter season – which we are now halfway through – with sufficient natural gas in storage sites. Gas withdrawals across Europe have accelerated in the past 10 days, … For more info go to https://shorturl.at/hlEKM

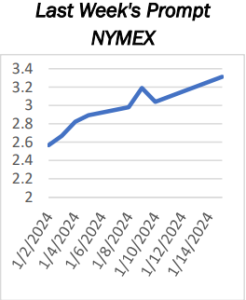

Natural Gas Remains On The Downside Ahead

Natural Gas (XNG/USD) dips lower in a horrific week amounting to near 7% of losses. Markets seem to have reached the end of their enthusiasm when it comes to pricing in rate cuts by the world’s major central banks. Meanwhile, recent data suggests that the German economy is coming to a halt, while other countries in the Eurozone also start to signal slowdowns in their economic indicators. This means less demand from Europe for Natural Gas. Meanwhile, the US Dollar (USD) is not helping as the Greenback is pumping higher on Tuesday. US markets were closed on Monday due to Martin Luther King Birthday, and the US bond market has opened with a bang in Asia. Headlines on former US President Donald Trump obliterating his competition in the first Republican Presidential Candidate runoff for Iowa… For more info go to https://shorturl.at/rwyQU

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.