Oil Markets: Red Sea Threats, Russian Exports, and 2024 Economic Projections

Crude oil futures are experiencing significant volatility this week, with prices trading 55 cents per barrel higher this morning. The market has been marked by fluctuations between gains and losses in the overnight session, driven by reports of Houthi militants attacking a US-owned commercial vessel in the Red Sea. This incident has added to the existing geopolitical tensions in the Middle East, and it follows a rally in crude oil prices observed last Friday, where prompt crude saw an increase of approximately 60 cents per barrel.

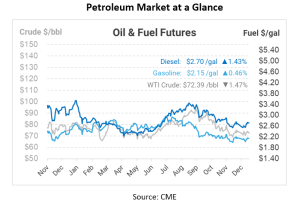

While Brent futures remained flat yesterday due to the Martin Luther King holiday, WTI (West Texas Intermediate) and Brent currently trade $1.3 and $1.9 per barrel higher year-to-date, respectively.

Houthi forces launched an anti-ship ballistic missile at the US-owned dry bulk ship Gibraltar Eagle, according to US Central Command. The attack took place on Monday, around 8 am ET. Fortunately, there were no reported injuries or significant damage to the vessel. In response, US and British forces conducted airstrikes on Houthi targets in Yemen. Despite these actions, the Houthi attacks in the Red Sea persist, indicating their determination to continue such activities in the region.

Another factor impacting crude oil supply dynamics is Russia’s seaborne crude shipments, which rose by 166,000 barrels per day (bbl/d) last week to reach 3.45 million barrels per day. This increase, however, falls significantly short of the production cut commitments made by Moscow to its OPEC+ partners. It’s noteworthy that all Russian crude en route to Asia continues to pass through the Red Sea, which has become a focal point for energy market observers due to its strategic importance.

The Global Investment Research (GIR) group has released insights regarding their views on the commodity complex as we enter 2024. Despite a year marked by flat returns for commodities, GIR sees selective pockets of directional opportunity emerging. This is driven by the strengthening cyclical demand case for commodities, fueled by improved GDP growth resulting from favorable financial conditions and the potential for policy rate cuts.

On a global scale, the trend of disinflation continues to be a key concern. GIR suggests that even with relatively pessimistic assumptions for categories such as financial services and nonprofit organizations, last week’s Consumer Price Index (CPI) and Producer Price Index (PPI) imply a sequential core Personal Consumption Expenditures (PCE) increase of 0.17% in December. However, GIR anticipates that this positive “January effect” will be unwound in subsequent releases. In the US, the economic outlook is more optimistic, with expectations of stronger Gross Domestic Product (GDP) growth in 2024 and a lower risk of recession.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.