Natural Gas News – October 19, 2023

Natural Gas News – October 19, 2023

U.S. Natural Gas Output To Rise 5% In 2023 On Permian Push

U.S. natural gas production will increase by 5% or 5 billion cubic feet per day in 2023, and by 2% next year, with growth primarily in the Permian basin region and driven by high oil prices and improved well-level productivity, the Energy Information Administration (EIA) forecast on Wednesday. The EIA estimates that Permian region natural gas production alone will increase by 11% in 2023 and 6% in 2024. Currently, the Permian region accounts for around 25% of all marketed natural gas produced in the U.S. Lower 48 states. Spurring production is an increase in oil prices, which particularly affects Permian gas due to the fact that most of this is associated natural gas production from oil wells, rendering production in tandem with crude prices. The EIA noted that continued advances in hydraulic fracturing and horizon… For more info go to https://shorturl.at/frEH5

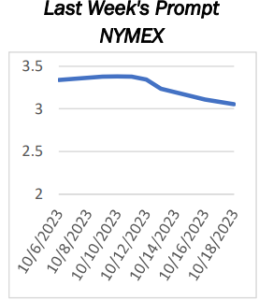

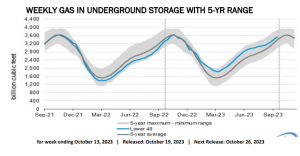

Natural Gas Prices Forecast: Futures Face Bearish Pressures

U.S. natural gas futures are currently under pressure, hovering near two-week lows as traders eagerly await the Energy Information Administration’s (EIA) Weekly Storage report. Market sentiment remains subdued due to a combination of record production rates and lackluster demand forecasts. The forthcoming EIA report is predicted to show an 82 Bcf build, marginally below last week’s 84 Bcf increment. Current working gas storage stands at 3,529 Bcf, which is within the five-year historical range and significantly above last year’s levels. The statistics indicate a relatively robust supply situation, potentially acting as a ceiling for price gains in the short term. Financial firm LSEG noted that average gas output in the Lower 48 states hit a new high this month, increasing to 103.6 billion … For

more info go to https://shorturl.at/egxR9

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.