IRA’s Renewed Focus: A Cleaner, Greener Energy Landscape

The Inflation Reduction Act (IRA) has been a game-changer in the United States’ efforts to address inflation and stimulate economic growth. While its biggest impacts are projected to be felt in the coming years, the IRA has already set in motion a series of changes across different industries.

Green Initiatives

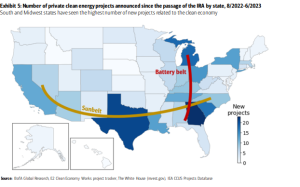

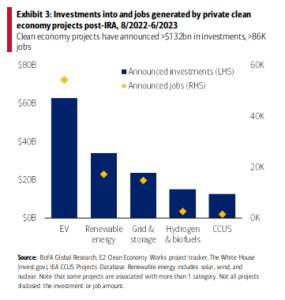

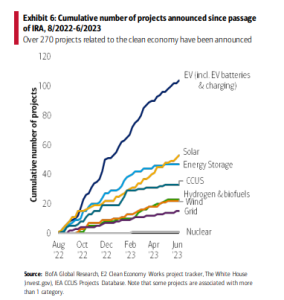

Data from BofA Global Research reveals that while the IRA’s most significant effects are expected in 2024 and 2025, there have already been announcements of more than 270 new clean energy projects, with total investments reaching around $132 billion. Nearly half of this investment has gone into electric vehicles (EVs) and batteries, with the rest directed toward renewable energy sources like solar and wind power, grid infrastructure and storage, and clean fuels.

These investments are predicted to create over 86,000 jobs, including 50,000 in the EV industry.

IRA has introduced various tax credits to support clean hydrogen fuel, biofuels, and sustainable aviation fuel. These incentives are set to accelerate the growth of renewable energy projects, with a combined capacity of at least 25GW, enough to power 22 million homes.

- 45V New Clean Hydrogen Production Tax Credit: This creates a 10-year support for clean hydrogen production.

- 45Z New Clean Fuel Production Credit: Establishes a technology-neutral 2-year tax credit for low-carbon transportation fuel.

- 40B New Sustainable Aviation Fuel (SAF) Credit: Provides an incentive to reduce aviation transportation emissions.

- 45Q Carbon Capture and Sequestration Tax Credit: Enhanced for carbon capture and direct air capture.

- Extension of Second-Generation Biofuel Incentives through 2024.

- Extension of Biodiesel and Renewable Diesel Credit through 2024.

Clean hydrogen, which can be produced through various methods, including nuclear and renewable energy, is poised to play a pivotal role in reducing emissions. The IRA incentivizes clean hydrogen production through tax credits, promoting its use in various sectors.

Biofuels are also a significant focus, with the IRA offering a 30% biogas Investment Tax Credit (ITC) to support the development of biodigester systems and an extension of biodiesel and renewable diesel tax credits.

Sustainable aviation fuel (SAF) is another critical component of the IRA’s clean energy initiatives. It introduces tax credits and incentives to promote SAF production, contributing to reduced aviation emissions.

The clean energy initiatives are expected to have a profound impact on reducing greenhouse gas emissions and promoting sustainable practices in the energy sector.

Carbon Capture, Use & Storage (CCUS)

IRA’s long-term goal is to achieve a substantial reduction in greenhouse gas emissions by 2030. To support this objective, carbon capture and storage (CCUS) projects have been announced, with a total removal capacity of around 1,800 metric tons of carbon dioxide per year. However, the CCUS industry is still in its early stages and faces commercialization and cost challenges. To address this, the IRA has launched a $6 billion Industrial Demonstrations Program, providing funding for early-stage commercial-scale projects. This initiative is expected to accelerate CCUS development and help the US achieve its emissions reduction goals.

Electrifying the Auto Industry

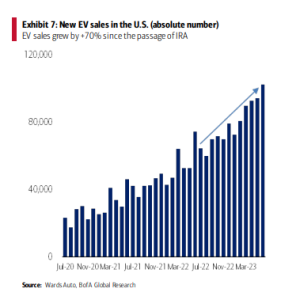

IRA has sparked a significant ramp-up in electric vehicle (EV) investments in the US. Automakers and their suppliers have announced over $62 billion in investments in EVs, doubling the amount announced in 2020. These projects aim to expand annual battery production capacity, increase EV charger production, and boost the production of electric vehicles. The IRA’s clean vehicle tax credits are expected to improve the affordability of EVs and drive greater demand in the short term, ultimately increasing the penetration rate of alternative powertrain vehicles.

Challenges and Transition Costs

While IRA has accelerated the growth of renewable energy, it has also presented challenges for the oil & gas industry. Transitioning away from fossil fuels can be costly, and some companies may struggle to adapt. Additionally, a comprehensive strategy that balances the benefits of renewable energy with the needs of existing industries will be crucial in ensuring a sustainable and prosperous future for all. The IRA has set the stage for a greener, more sustainable energy landscape, and its effects will continue to shape the future of our energy sector.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.