Natural Gas News – October 17, 2023

Natural Gas News – October 17, 2023

Natural Gas Prices Forecast: US Rebounds, Europe Tumbles

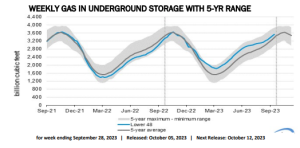

US natural gas futures clawed back some losses on Tuesday, rising to $3.129 after a four-day sell-off. The rebound likely reflects traders booking profits, as weather forecasts still don’t indicate a surge in demand. While a cool system is expected in the Great Lakes and Northeast next weekend, the overall weather pattern for much of the U.S. remains warm, limiting natural gas demand. Mild weather forecasts through late October further cement a bearish outlook. On the supply side, natural gas output in key shale basins is expected to drop by 0.5 billion cubic feet per day (bcfd) to 98.8 bcfd in November, marking a fourth consecutive month of declines. This decrease in production comes despite average gas output in the Lower 48 states rising to 103.4 bcfd this October. Additionally, pipeline exports to Mexico are c… For more info go to

https://shorturl.at/bgOZ0

Nat-Gas Prices Under Pressure as Mild U.S. Weather

November Nymex natural gas (NGX23) on Monday closed -0.127 (-3.92%). Nat-gas prices on Monday extended last Friday’s losses to a 1-week low and closed sharply lower as warmer weather is expected in much of the eastern U.S. while weather in the western U.S. is cooler, cutting nat-gas demand for heating and air conditioning.

Maxar Technologies said the remnants of the West Pacific Typhoon Bolaven will keep temperatures cooler along the West Coast over the next two weeks and warmer in the eastern two-thirds of the U.S. Natgas prices have carryover support from last Friday’s rally in European nat-gas price to an 8-month high on concerns about global supplies

after Chevron shut down a nat-gas production field in Israel because of safety concerns after Hamas militants attacked Israel last week…For more info go to https://shorturl.at/npNU1

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.