Biden Seeks Peace Efforts as Oil Markets Navigate Global Diplomacy

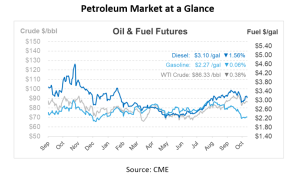

Crude futures are trading around 30c/bbl lower this morning after experiencing more relief during yesterday’s session. Both Brent and WTI closed yesterday over $1/bbl lower amid continued international diplomatic discussions over the conflict in the Middle East. Last week, both oil benchmarks increased 7.5%, accounting for the biggest weekly gain since February, so markets are eager for some price slips.

Over the weekend, the ongoing conflict between Israel and Hamas did not escalate significantly, and markets are speculating about the future implications of the conflict. With the potential implication of Iran, either directly or through the US tightening sanctions, many are skeptical of the consequences for the global oil market. President Biden is scheduled to visit Israel on Wednesday in an attempt to broker peace. Any significant developments during or after this visit could sway market sentiment and influence crude prices. The war has already affected oil transportation costs, with rates spiking on average over 50% this week across 16 major global trade routes.

Reports indicate that the US and Venezuela are on the brink of reaching an agreement. This agreement might relax sanctions on Venezuelan crude imports, affecting the supply and, consequently, the price of crude oil. A deal is expected to be signed on Tuesday to allow banned opposition candidates to run in Venezuela’s 2024 presidential election. This move by the US aims to foster democratic elections in Venezuela in exchange for sanction relief. Following this agreement, the US might ease oil-related sanctions, enabling Venezuela’s state-owned oil agency to conduct business with the US and other nations again. If sanctions are lifted, Venezuela, which has the world’s largest proven reserves of sour heavy crude, could significantly affect the supply side of the equation.

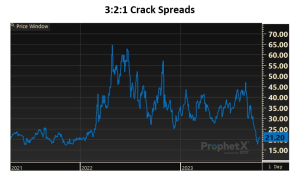

Gasoline crack spreads or refining profits have dropped to their lowest levels since 2020, meaning that some refiners are incurring losses when producing gasoline. The EIA is predicting a drop in US production for the second month in a row. Combined with the seasonally low gasoline demand and moves by institutional investors to reduce their positions, this has placed downward pressure on crude prices, even before the geopolitical events in the Middle East began.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.