Week in Review – September 8, 2023

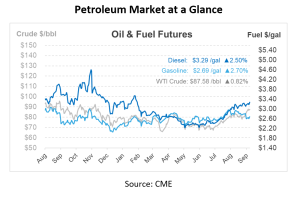

This week, crude oil prices showed upward pressure, opening above $86 a barrel on Friday. Despite economic uncertainty, investors have been buoyed by indications of tightening supply. Prompt crude futures reflected this sentiment, with a rise of around 70c/bbl, signaling a weekly gain of over 2%. This week also saw Prompt WTI and Brent reach $88.08/bbl and $91.15/bbl, respectively. With all the price increases, crude prices touched their highest for the year, influenced in part by the unexpected decision of Saudi Arabia and Russia to prolong output cuts until the end of the year. The market had anticipated the extension to last only through October.

OPEC+ members’ production cuts have led to a scarcity in medium and heavy sour grades of crude oil, pushing their prices higher and overturning the usual price dynamics. The majority of Saudi Arabia’s crude oil exceeds the 1% sulfur mark, classifying it as sour. Refineries reliant on Middle Eastern and African crudes are usually configured to process heavier, more sour crude oils, and cannot easily substitute “sweeter” blends like WTI or Brent. If the shortage of sour crude continues, some refineries in other regions could face supply pressures, potentially impacting output. Down the road, that could mean that more US and European diesel may need to be routed elsewhere to keep up with demand.

China has been at the forefront of economic discussions lately. Although there was a surge in its service-sector activity earlier this year after the lifting of Covid restrictions, the subsequent months have seen a slowdown in economic growth. Factors such as the end of China’s extended property boom, a challenging export environment, and conservative government policies are contributors. However, China’s crude oil imports rose substantially in August due to refiners building inventories and increasing processing to exploit the lucrative profit margins from fuel exports. August imports stood at an impressive 12.43 million bpd, marking the third-highest daily rate ever.

In a move to counterbalance high prices and due to seasonal refinery maintenance, Russia intends to cut its diesel exports from ports on the Black and Baltic Seas by a quarter. This month is also expected to witness a 44% month-on-month increase in Russia’s offline oil refining capacity, reaching 4.6 million metric tons. Although this rise would technically augment available crude volumes in Russia, the nation’s extended voluntary export cuts mean this surge won’t boost exports. Come October, there’s an expectation for the offline refining capacity to regress as maintenance wraps up.

The EIA’s report from Thursday gave insights into the U.S. crude inventories for the week ending September 1st. There was a higher-than-anticipated crude draw of 6.3 million bbls, in comparison to Reuters’ expectation of a 2.1 million bbl draw. Gasoline also showed a draw, and in comparison with the five-year average for this period, U.S. crude oil, gasoline, and distillate inventories are down by 4%, 5%, and 14%, respectively.

Prices in Review

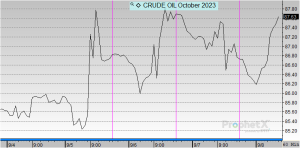

Crude opened the week at $86.06, and saw slight increases each day. This morning, crude opened at $86.78, an increase of 72 cents or 0.837%

Diesel opened the week on Tuesday at $3.1215 with small up-and-down swings over the next few days. This morning, diesel opened at $3.2213, an increase of nearly 10 cents or 3.197%.

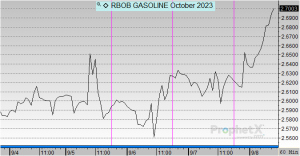

Gasoline opened the week at $2.5974 before increasing on Thursday and Friday. This morning, gasoline opened at $2.6251, an increase of almost 3 cents or 1.066%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.